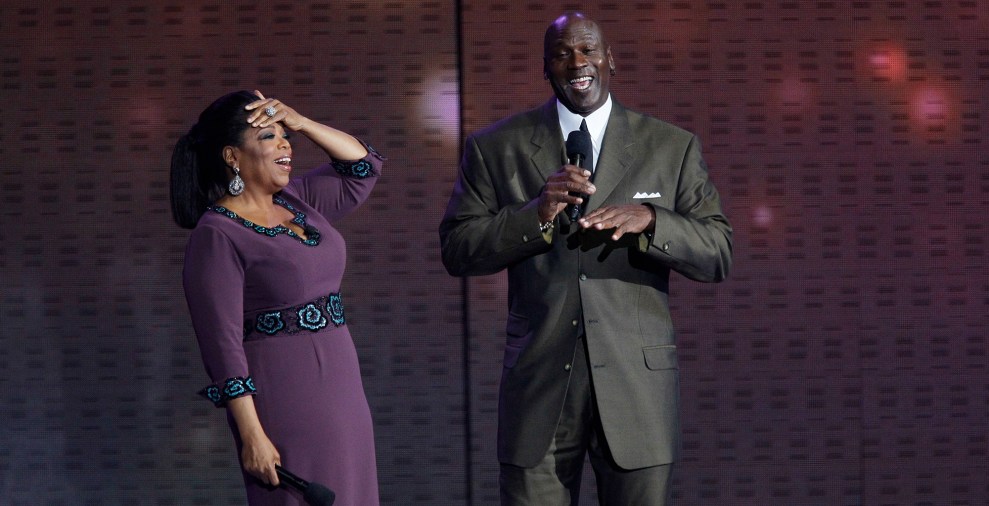

Mother Jones; Getty

At first I figured the Republicans would be all over this. I guess I figured wrong.

I’m referring to the bombshell working paper that made headlines earlier this week, in which a team of academic and Treasury Department economists found that the IRS audits Black taxpayers at roughly three to five times the rate of non-Black taxpayers.

The authors, whose findings were based on an anonymized 2014 dataset consisting of more than 148 million tax returns and 780,000 audits, write that the disparities seem to be driven largely by racial differences in audit rates among taxpayers claiming the Earned Income Tax Credit.”

The IRS has long scrutinized claimants of the EITC and certain other refundable tax credits at higher-than-average rates, regardless of race, in part because they are low-hanging fruit. The credit—aimed at low- to moderate-income taxpayers—is often claimed in error, and such audits are a cheap and easy by-mail job for a chronically underfunded tax agency.

Even among those claimants, the study found, Black taxpayers, who accounted for an estimated 21 percent of EITC filers, were selected for 43 percent of the audits. Now, IRS staffers don’t sit around deciding whom to audit—the selection is algorithmic and nominally race-blind. But the agency’s secret sauce somehow produced results that are far from colorblind.

Lacking access to the code—which is indeed secret—the authors tried out different models to make sense of the disparity, and suggested ways that the IRS might fix the problem. Race-wise, for instance, one gets very different results using an algorithm that emphasizes the likelihood of any under-reporting of income by EITC claimants vs one that emphasizes the magnitude of under-reporting. Stanford, one of the institutions involved, has a good summary here.

Based on their recent anti-IRS rhetoric, I fully expected Republican lawmakers—in their seemingly relentless effort to gut the IRS’s budget, deprive the agency of the resources required to audit rich people, and even abolish it entirely—to pounce on the findings and distort them to suggest the Biden administration has it out for the little guy. I’ve seen a little bit of this, but surprisingly little.

In truth, these race disparities may well be the partial result of Republican policies. Audit rates plummeted across the board after the GOP took back Congress in 2010 and proceeded to eviscerate the IRS’s enforcement budget. From 2011 to 2017, audits of EITC claimants declined by about 45 percent, but audits of taxpayers reporting income of $500,000 or more fell way more steeply—by as much as 78 percent.

Starved of funding and accounting manpower by Republican lawmakers, the IRS bean-counters all but gave up on complex, high-dollar audits in favor of automated audits by mail—which now make us some 70 percent of all audits, and which the authors emphasize are “substantially cheaper” and “can be particularly burdensome for lower-income households.” The study itself stems from President Joe Biden’s day-one executive order directing all federal agencies to assess their programs for racial equity.

Last year’s Inflation Reduction Act, which not a single congressional Republican supported, replenished the IRS’s coffers with almost $80 billion over 10 years. The enforcement component (roughly $46 billion) is expected to yield a 450 percent return by restoring the IRS’s ability to collect the taxes owed by rich Americans—including former president Donald Trump—who were rarely audited on his watch. Congressional Republicans are trying to repeal the new funding via the Family and Small Business Taxpayer Protection Act—a curious moniker for a bill that would mainly protect tax cheaters.

The House bill also aims to claw back $403 million from the Treasury Inspector General for Tax Administration, a watchdog that generates reports such as this one, noting that the IRS had failed to collect more than 60 percent of 2019 taxes—some $2.4 billion—still owed by delinquent individuals with incomes of $1.5 million and up. In 2020, the Inspector General reported that nearly 880,000 “high income” non-filers from 2014 through 2016 still owed the government $46 billion—and that the 300 biggest delinquents owed about $33 million per head, on average. It’s not hard to see how such reports might annoy certain political megadonors.

Republican lawmakers have gone wild spreading the utterly false claim that the IRS is hiring 87,000 new agents to go after small businesses and everyday Americans—like you! But so far, I’ve only seen a couple of them—one being Tim Scott, the Senate’s only Black Republican—allude to this new race study in a tweet, and both of GOP tweets I saw repeated the 87,000 falsehood. Not one of the 25 Republicans on the House Ways and Means Committee, which makes tax policy, has tweeted about it, though one Democratic member did—and the Democratic Ways and Means group account retweeted her. (The Republican account didn’t bother.)

Republicans have spent decades cutting necessary resources from the IRS, forcing the agency to rely on automated systems that unfairly target Black Americans for audits. https://t.co/1HlW6cFwXV

— Rep. Suzan DelBene (@RepDelBene) February 2, 2023

Why such a tepid GOP response? Perhaps Kevin McCarthy and the others figure the GOP base won’t care that Black people are over-audited. Heck, maybe they think the base will approve.

Or maybe, as much as they detest taxation, this is one anti-IRS narrative that the anti-CRT crowd simply cannot embrace: a contemporary example of systemic racial discrimination baked into, if not the laws themselves, then the implementation of those laws.

Seems like GOP Kryptonite.