Jeff Chiu/AP

On Friday, regulators shut down Silicon Valley Bank, one of the most prominent banks in Silicon Valley’s venture capital and startup hub. The bank’s collapse, the largest such failure since the 2008 financial crisis, has roiled the tech industry, in part because many venture capitalists and startups had millions in the bank coffers. The fate of those funds is now uncertain, potentially putting a number of tech companies, but also, the many jobs they provide—at significant risk.

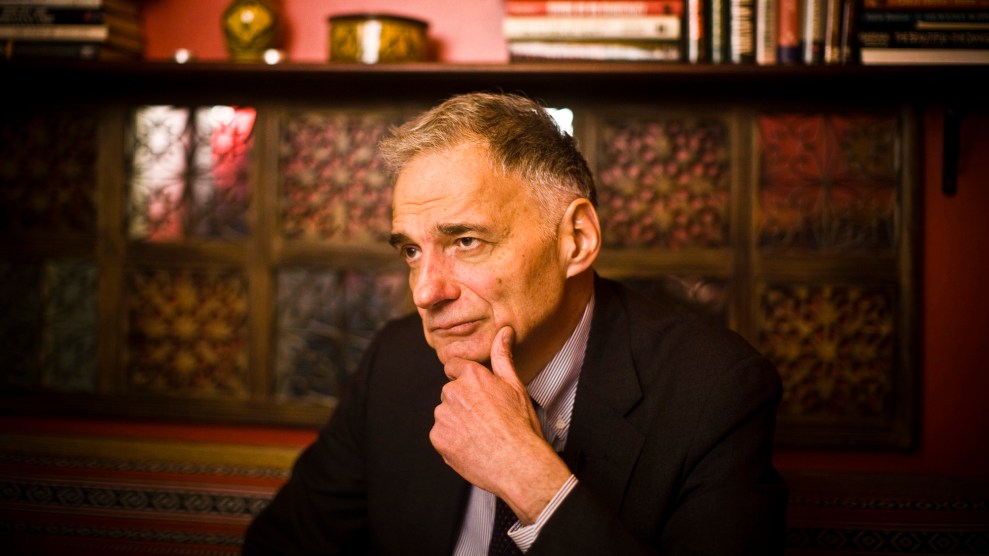

This precarious scenario, however, may not have been been the case were it not for the work of SVB’s President Greg Becker, who eight years ago asked a Senate committee to relax regulations that would soon be applied to his own bank. His appearance kicked off a half-a-million-dollar lobbying effort that led to a bill, signed by then-President Trump, undoing regulations precisely as SVB and other banks had asked for.

At the 2015 Senate hearing, Becker had his sights set on chipping away at a portion of the Dodd-Frank Act, the sweeping Wall Street reform bill passed in the wake of the 2008 financial crisis. A key rule in the law required that “Too Big To Fail” banks—which Dodd-Frank defined as those with more than $50 billion in assets—undergo stricter oversight, including higher capital ratio requirements designed to shore up the big banks’ ability to withstand financial shocks.

Becker, along with several other banking executives, asked senators to raise the threshold for banks that should be subject to this expanded level of supervision from $50 billion in assets—a milestone his bank was quickly approaching—to $250 billion. His testimony explained that the stricter risk checks would needlessly cost his banks millions, diverting resources from their ability to lend to “small and growing businesses” that are “job creation engines.”

He argued that there was no need for these expensive, federal-government-mandated checks because SVB’s activities had a “low risk profile”—and because the bank was perfectly capable of keeping itself in check with its “strong risk management practices.”

Following the hearing and three years of SVB lobbying lawmakers, Becker got his wish: In 2018, Trump signed a bill into law raising the threshold for stricter bank oversight to $250 billion in assets.

Fast forward to 2023. With about $209 billion in assets, SVB has continued to operate below the bar where they’d be subject to stricter risk checks. For years, they’ve invested the bulk of their clients’ deposits in hopes of earning returns. But in recent months, many of their startup clients have come to the bank to withdraw money, faced with a new landscape where taking on debt to operate their businesses is a lot more expensive, thanks to the Fed’s recent aggressive hikes in interest rates. But SVB didn’t have enough liquid cash to pay all of those requests at once. The result: major losses at the bank and, on Friday, a full-on collapse—the exact sort of bank failure that the original regulations that Becker fought against had set out to prevent.