Mother Jones Illustration/Shuttershock

This post was originally published as part of “The Trump Files“—a collection of telling episodes, strange but true stories, and curious scenes from the life of our current president—on July 12, 2016.

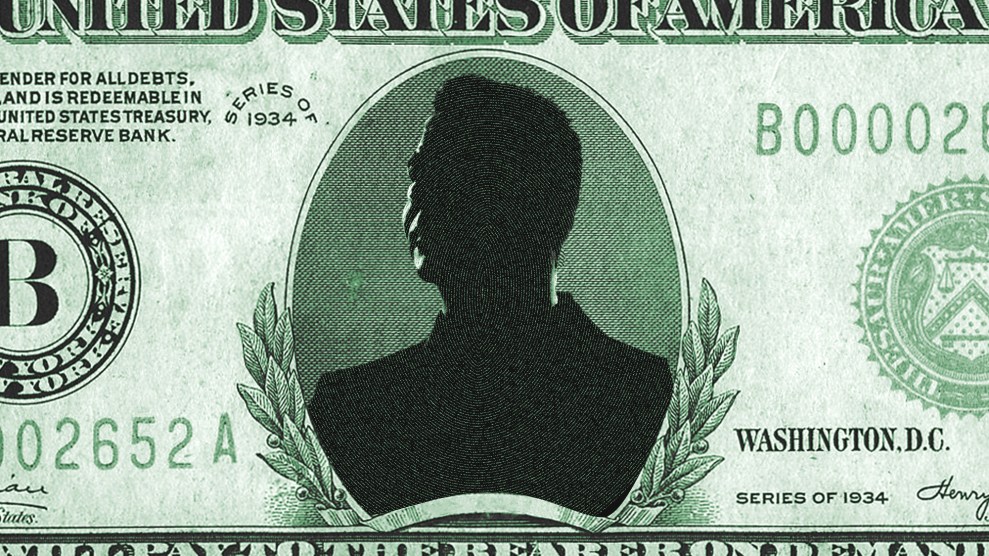

Donald Trump loves to (falsely) complain at his rallies and speeches that America is “the highest-taxed country in the world.” His tax plan would slash income tax rates and deliver huge savings to the richest Americans. But he wasn’t always a fan of trickle-down, supply-side tax cuts.

In 1991, Trump told the House Budget Committee’s Subcommittee on Urgent Fiscal Matters that President Ronald Reagan had screwed up with his 1986 tax cuts, which cut the highest income tax rates nearly in half, from 50 percent to 28 percent.

“In the real estate business we’re in an absolute depression, and one of the reasons we’re there is what happened in 1986,” he said. “Something has to be done. It has to be brought back. It has to be reformed.”

Trump contended that the low income tax rates took away rich people’s reason to invest and that the economy as a whole suffered as a result. He recommended a return to much higher rates for the rich, arguing that they cause more people to invest in real estate. But he didn’t quite explain why that would happen. “The fact is that 25 percent for high-income people—for high-income people—it should be raised substantially,” he said. “I say leave the middle, leave the low—lower ’em. But people with money have to have the incentive.”

A tax rate of 25 percent (which Trump erroneously thought was the top income tax rate at the time) is now the maximum income tax rate that Trump calls for in his 2016 tax plan.

Read the rest of “The Trump Files”:

- Trump Files #1: The Time Andrew Dice Clay Thanked Donald for the Hookers

- Trump Files #2: When Donald Tried to Stop Charlie Sheen’s Marriage to Brooke Mueller

- Trump Files #3: The Brief Life of the “Trump Chateau for the Indigent”

- Trump Files #4: Donald Thinks Asbestos Fears Are a Mob Conspiracy

- Trump Files #5: Donald’s Nuclear Negotiating Fantasy

- Trump Files #6: Donald Wants a Powerball for Spies

- Trump Files #7: Donald Gets An Allowance

- Trump Files #8: The Time He Went Bananas on a Water Cooler

- Trump Files #9: The Great Geico Boycott

- Trump Files #10: Donald Trump, Tax-Hike Crusader

- Trump Files #11: Watch Donald Trump Say He Would Have Done Better as a Black Man

- Trump Files #12: Donald Can’t Multiply 16 and 7

- Trump Files #13: Watch Donald Sing the “Green Acres” Theme Song in Overalls

- Trump Files #14: The Time Donald Trump Pulled Over His Limo to Stop a Beating

- Trump Files #15: When Donald Wanted to Help the Clintons Buy Their House

- Trump Files #16: He Once Forced a Small Business to Pay Him Royalties for Using the Word “Trump”

- Trump Files #17: He Dumped Wine on an “Unattractive Reporter”

- Trump Files #18: Behold the Hideous Statue He Wanted to Erect In Manhattan

- Trump Files #19: When Donald Was “Principal for a Day” and Confronted by a Fifth-Grader

- Trump Files #20: In 2012, Trump Begged GOP Presidential Candidates to Be Civil

- Trump Files #21: When Donald Couldn’t Tell the Difference Between Gorbachev and an Impersonator

- Trump Files #22: His Football Team Treated Its Cheerleaders “Like Hookers”

- Trump Files #23: The Trump Files: Donald Tried to Shut Down a Bike Race Named “Rump”

- Trump Files #24: When Donald Called Out Pat Buchanan for Bigotry

- Trump Files #25: Donald’s Most Ridiculous Appearance on Howard Stern’s Show

- Trump Files #26: How Donald Tricked New York Into Giving Him His First Huge Deal