Protesters dropped hundreds of prescription bottles in front of Purdue Pharma's Stamford, CT headquarters after news broke of the settlement proposal.Erik McGregor/Getty

Last week marked a new chapter in the opioid epidemic: Purdue Pharma, creator of the blockbuster painkiller OxyContin, filed for bankruptcy as part of a tentative settlement with the thousands of municipalities suing the company for its role in the overdose crisis. In a press release, Purdue claimed the settlement would “provide more than $10 billion of value to address the opioid crisis.”

Yet critics argue that the actual amount of assistance would likely be much less—and that a settlement would leave fewer opportunities to understand the company’s role in the crisis while leaving open the possibility that the company’s owners, the Sackler family, continue to profit off of the sale of opioids internationally.

The tentative deal would restructure Purdue in the form of a trust: profits from future domestic OxyContin would be distributed among the plaintiffs as they address the costly consequences of the overdose crisis. The Sacklers would sell Mundipharma, their pharmaceutical company that markets OxyContin and other drugs overseas and would also give $3 billion to the plaintiffs over seven years. That money would either come from the Sacklers’ personal accounts, Mundipharma’s sale, or a combination of the two. Critically, the settlement would halt current and future opioid lawsuits against both Purdue and the Sacklers, both of whom deny any wrongdoing. The details of the deal, which have been reported on but not released publicly, could change over the course of months to come during bankruptcy proceedings, which started last week under White Plains Judge Robert Drain.

Proponents argue that a settlement would avoid a protracted, expensive trial and bring desperately needed money for addiction treatment and other necessary services quickly. So far, plaintiffs in the massive federal litigation—involving thousands of counties, tribal lands, hospital systems, and unions—have agreed to the proposed deal. Nearly every state attorney general has separately sued Purdue, and about half support the deal.

Other state attorneys general have vocally opposed it, with AGs in Massachusetts, New York, and Connecticut taking particularly assertive stances. “The Sacklers would like the public to believe they’re cutting a check for billions of dollars,” said Massachusetts AG Maura Healey in a statement. “They’re not. Their proposal, which we believe is worth far less than they say, wouldn’t require them to pay back a dime of the billions they’ve earned from OxyContin sales.” Whether these opposing states will be subject to the settlement is now up to Judge Drain.

Here are the deal’s red flags:

The settlement amount could be far less than what Purdue says—and would come partly from future opioid sales

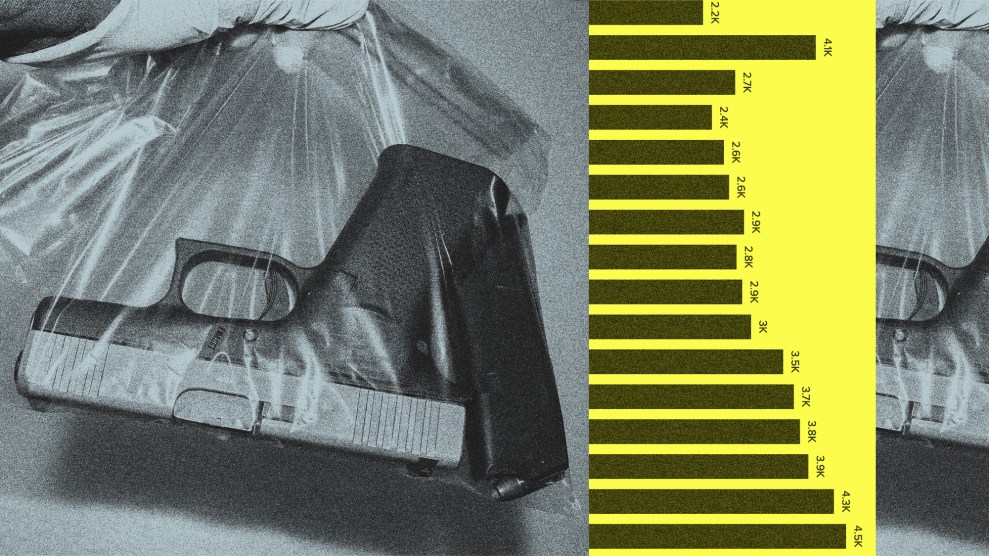

The “$10 billion settlement,” as it’s been described by Purdue and a number of media outlets, isn’t a hard number. The exact settlement amount will depend largely on future pharmaceutical sales—including sales of OxyContin—both in the United States and abroad in the years to come. It also includes the value of overdose reversal drugs that Purdue would contribute in kind. In fact, $10 billion is the best case scenario: the current deal only guarantees $4.4 billion in cash, according to sources familiar with the proposal.

There is precedent for forming a trust as part of a settlement: tobacco companies paid have billions to states out of annual revenues as a result of the 1998 Big Tobacco settlement (though a relatively small portion has gone towards tobacco prevention efforts). “There are many cases without enough money to go around and where claimants will need relief for a long time,” explained Lindsey Simon, a law professor at the University of Georgia focusing on bankruptcy. The solution: “Put all the claims and all the assets in one place and put someone in control of it.”

But critics argue that funding the response to the opioid crisis by selling more opioids creates perverse incentives. In recent years, Mundipharma, which boasts revenues in excess of $1 billion, has been accused of promoting OxyContin abroad using the same tactics as it did in the United States. A 2016 Los Angeles Times investigation described the company as “moving rapidly into Latin America, Asia, the Middle East, Africa and other regions, and pushing for broad use of painkillers in places ill-prepared to deal with the ravages of opioid abuse and addiction.” Promotional videos for the company, according to the article, “feature smiling people of many ethnicities, suggest the companies regard OxyContin’s U.S. success as merely a beginning.”

The Sacklers could continue to profit off of opioid sales—and would remain billionaires

Under the proposed settlement, the Sacklers would pay a guaranteed $3 billion to the plaintiffs, and roughly $1.5 billion more if Mundipharma sells for more than $4.5 billion. Above the $4.5 billion threshold, the plaintiffs and the Sacklers would split the profits equally.

The initial $3 billion would make up the bulk of the guaranteed cash to the plaintiffs, because Purdue itself has little in the way of assets other than ownership of OxyContin. The Sacklers, meanwhile, are among the richest families in America. According to lawsuits in Oregon and Massachusetts, the family transferred between $4 and $10 billion from the company to personal accounts over the past decade. This transfer appears to have been part of a long term plan. As the Washington Post recently reported, in 2008, Purdue board member advised Purdue chief executive Richard Sackler, “In the event that a favorable [recapitalization] deal cannot be structured during 2008, the most certain way for the owners to diversify their risk is to distribute more free cash flow to themselves.”

More evidence of this plan surfaced last week, when New York Attorney General Letitia James alleged a new $1 billion transfer, including through Swiss bank accounts, from Purdue to Sackler family members. The finding turned up in response to a subpoena—one of 33 subpoenas that James issued last month to financial institutions and advisers used by the Sacklers in an effort to understand the full extent of the family’s wealth, which Forbes estimates to be worth $13.5 billion. It’s unclear if the results of the other 32 subpoenas will see the light of day, as the Sacklers recently filed a motion to quash them.

Attorneys general have a dog in the fight

State attorneys general have more than money on the line: they they want to be able to show their constituents that they won big in the fight on opioids. So far, support for the settlement largely falls on partisan lines. With a handful of exceptions, Republican AGs support the settlement, and Democratic AGs do not. There could be a number of reasons behind the split. The AP recently noted Purdue’s historic support of Republican Attorneys General Association: $680,000 to the group between 2014 and 2018, compared to $210,000 to the group’s democratic counterpart.

In addition, many of the states rejecting the settlement have sued the Sackler family separately from Purdue, and so have more to lose in the event that a settlement deal halts suits against the family. Meanwhile, many of the states and localities agreeing to the settlement are represented by private firms—including some of the same firms that represented them during the Big Tobacco settlement. They are, in a way, following the Big Tobacco paradigm: File a suit, gather as much money as possible in a settlement, and move on. “Our goal has always been to bring desperately needed resources into local communities that, for years, have been forced to shoulder the devastating consequences and financial burden,” said Paul Hanly, the lawyer representing the federal lawsuit plaintiffs.

AG Healey sees it differently: “The settlement would be funded almost entirely by future sales of dangerous and addictive opioids. I find that deeply offensive, and it certainly doesn’t qualify as accountability in my book.”