Want to live in Manhattan? Good luck.<a href="http://www.trulia.com/blog/trends/rent-too-high/">Trulia</a>

A little more than a year ago, my former colleague Erika Eichelberger wrote about the fact that, for many, the rent is simply too damn high (I chipped in with some pretty charts illustrating an ugly problem). This story has been told time and time again, but a recent report from Bloomberg takes it one step further, at least for those of us lucky (or unlucky) enough to be entering the job market while living in San Francisco or New York City.

“The Starter Apartment Is Nearly Extinct in San Francisco and New York,” according the the article’s headline. Citing data compiled by real estate listings site Trulia, Bloomberg points out some depressing statistics: In San Francisco, 91 percent of one-bedroom apartments rent for more than $2,000 per month. It’s almost as bad in Manhattan, where 89 percent of one-bedroom apartments will set you back $2,000 month.

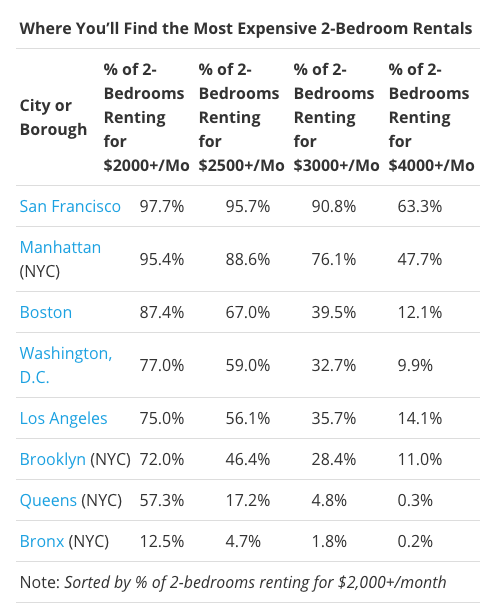

Trying to find a two bedroom? In San Francisco, almost every two-bedroom apartment rents for more than $2,000 (98 percent). Many are more than $2,500 (96 percent), or $3,000 (91 percent). More than half the two-bedrooms in San Francisco will put you back $4,000 per month. Take a look:

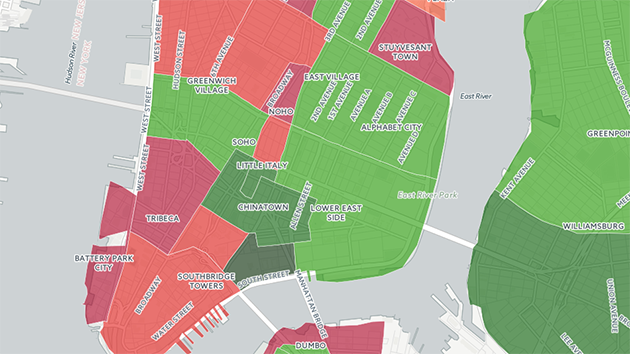

Obviously this applies to certain parts of these cities and, indeed, if you read through Trulia’s report, it breaks the data down by neighborhood. For instance, take a look at the interactive map of San Francisco below, which breaks down the cost of 1-bedroom units:

Here’s one for New York City:

So yes, chances are you can still find something, somewhere. But the point is that for many of us, that dream of life in the big city—for a reasonable amount of money and in a convenient location—is just that: a dream.