The funders behind Silicon Valley’s hottest companies tend to look a lot like the people they invest in: white and male.

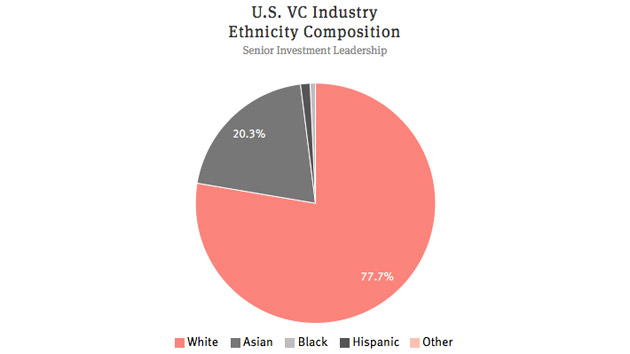

Of the 551 senior venture capitalists* examined in a new three-month study by the tech news site the Information and the VC firm SocialCapital, less than 1 percent (precisely four executives) were black, and another 1.3 percent were Hispanic. Twenty percent, or 110 people, were Asian.

While there has been considerable focus on the diversity figures of major companies such as Facebook and Twitter recently, little attention has been paid to the racial and gender makeup of the decision-makers who invest millions of dollars in tech startups, hoping they succeed.

Ninety-two percent of top venture capital executives are men. According to the report, that’s “way worse” than the gender disparity in tech companies, where 77 percent of leadership roles are occupied by men.

The striking numbers reinforce the narrative surrounding Silicon Valley’s diversity problems, as companies and civic leaders alike push to improve the racial and gender balance of the companies that make the gadgets and apps we consume. Not all VCs are doing poorly—the 15-person senior investment team at Y Combinator*, the well-known startup accelerator firm, has “four Asian men, a black man, three white women, and an Asian woman,” according to the report. Yet the report found that a quarter of firms have an all-white management crew.

As Mother Jones pointed out in July, the number of African Americans employees at Twitter, Facebook, and Google combined could fit on a single Airbus A830. Now we know the number of black venture capitalists, at least in this study, could fit in an Uber.

In an op-ed Tuesday titled “Bros Funding Bros: What’s Wrong with Venture Capital,” SocialCapital founder Chamath Palihapitiya criticized the backwards nature of the venture capitalist community and called for changes.

“The VC world is cloistered and often afraid of change—the type of change that would serve the world better,” Palihapitiya wrote. “An industry that wields the power to change lives is failing to do just that. Ultimately, fund investors will wake up to this bleak reality. We must change before this happens.”

You can check out the rest of the the Information‘s Future List here.

Correction: Following the publication of this story, Information and SocialCapital corrected several portions of their report, including their description of the racial and gender makeup of Y Combinator’s investment team. The story has been updated to reflect those changes.