The explosion of college tuition and student debt is leaving more grads with big bills and doubts about their futures. Some back-to-school stats:

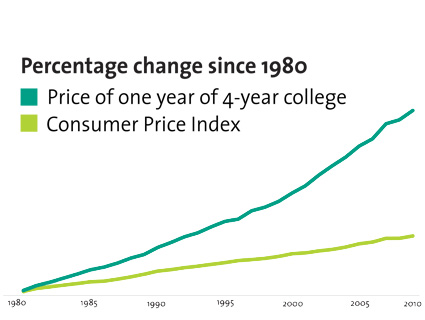

1. College costs a lot more than it used to.

The good news: College grads earn 84% more than high school grads.

The bad: Getting that sheepskin is getting a lot more expensive.

Between 2000 and 2012:

• Consumer Price Index increased 33%.

• Median household income (adjusted for inflation) dropped 9%.

• Average four-year college tuition increased 44%.

• Private for-profit tuition increased 19%.

• Private nonprofit college tuition increased 36%.

• Public college tuition increased 71%.

Between 2000 and 2012:

• Public spending on public education has dropped 30% even as enrollment at public colleges has jumped 34%.

2. So we’re borrowing more to go to school.

As college costs have shot up, so has student debt. Americans owe almost $1 trillion on their student loans, 310% more than a decade ago.

In 1989, 9% of households had student debt. Today nearly 20% do.

The average amount of student loan debt has increased 177% since 1989.

3. But we can’t pay it off.

Debt is increasing fastest for those who have the least money to pay it back.

56% of all student loan debt is owed by households headed by people 35 or older.

47% of total student loan debt is held by households with incomes below $60,000.

4. And we’re putting our dreams on hold.

Nearly half of college graduates with student debt say it has made it more difficult for them to make ends meet. 24% say it has affected their career choices.

25% of recent grads say student loan debt has made them take unexciting jobs just for the money.

Student debt’s impact on borrowers’ long-term plans:

• For every $10,000 in student debt: Borrowers’ likelihood of taking a nonprofit, government, or education job drops more than 5 percentage points. Their long-term probability of getting married drops at least 7 percentage points.

• Student loans affect the housing market: Larger student debt burdens are making it harder for recent college graduates to get home loans, according to the National Association of Home Builders.

• Student loans affect the entire economy: The Financial Stability Oversight Council reports that high student debt levels could “lead to dampened consumption,” and the Consumer Financial Protection Bureau warns that unpaid student loans “could be a drag on the recovery.”