On Tuesday, Mother Jones reported that a lobbyist for the Financial Services Institute, an industry trade group whose members stand to benefit from weaker investor protections, secretly wrote a letter signed by 32 progressive House Democrats aimed at scaling back new regulations the Department of Labor (DOL) wants to impose on retirement investment advisers. Now, in an only-in-Washington twist, FSI is citing the letter its lobbyist ghostwrote to bolster its case against these protections, including in a recent missive to the Securities and Exchange Commission (SEC) urging a delay in implementing them.

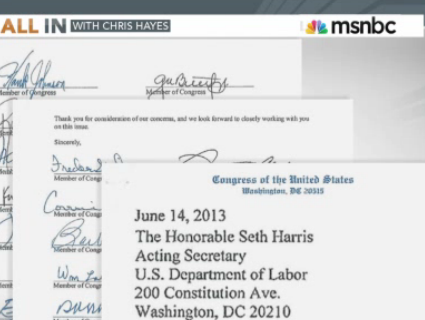

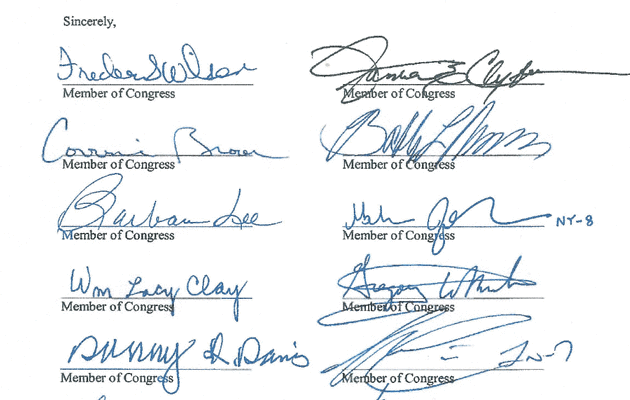

The June 14 letter, authored by FSI lobbyist Robert Lewis, was signed by lawmakers including Tulsi Gabbard (D-Hawaii) and David Scott (D-Ga.) and argues that the new safeguards the Labor Department is considering, which would force millions of retirement investment advisers to act in the best interest of their customers instead of their own, “could severely limit access to low-cost investment advice” for “the minority communities we represent.” FSI then cited its letter opposing the new rule—as if it had no hand in writing it—in a recent letter to the SEC, and on its own blog and website. (Hat tip to Claremont McKenna College political science professor John Pitney, who first noted this on his blog on Wednesday.)

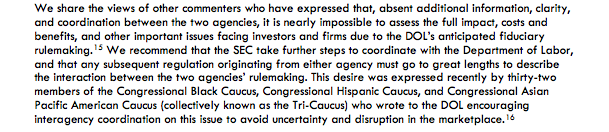

FSI’s July 5 letter to the SEC requesting that the rule be delayed and weakened notes that “we share the views of other commenters,” including the “thirty-two members of the Congressional Black Caucus, Congressional Hispanic Caucus, and Congressional Asian Pacific American Caucus…who wrote to the DOL encouraging interagency coordination on this issue to avoid uncertainty and disruption in the marketplace.” FSI did not disclose the fact that “the views of other commenters” are in fact its views. (FSI did not respond to a request for comment.)

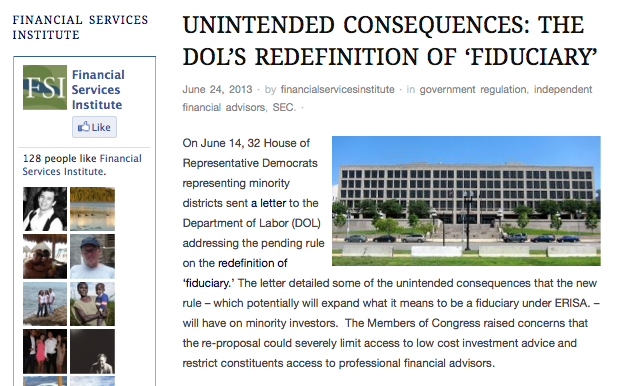

Here, FSI also cites the letter in support of its interests on its blog:

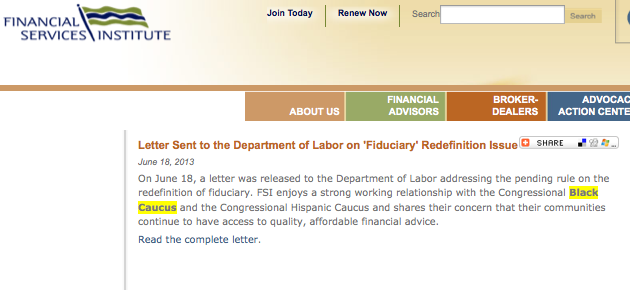

And here, the trade group cites the letter on its website:

The Labor Department rule would force retirement investment advisers to act in the best interest of their customers, instead of putting their own profits first as they legally can now—a move that could crimp industry revenue.

As I reported Tuesday, since the lawmakers who signed the letter represent low- and middle-income districts with large proportions of minority voters, it could help the financial industry make the case that there is broad-based concern about the new rule. FSI is doing all it can to make sure that case gets made far and wide.