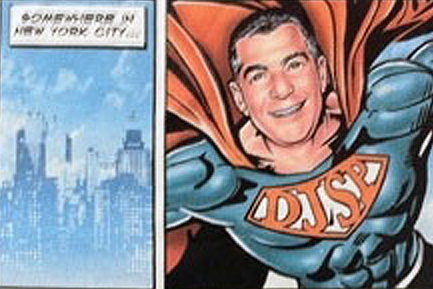

A caricature of David J. Stern, portrayed as Superman, as it appeared on a commemorative T-shirt.

Way back in August 2010, I sounded the alarm about a fellow named David J. Stern, a lawyer in Fort Lauderdale, Florida, who’d gotten rich off the housing meltdown of the mid-2000s. Stern ran a law firm that handled foreclosure cases as fast as possible for big banks and the quasi-governmental housing corporations Fannie Mae and Freddie Mac. But as I revealed, Stern’s law firm, paid per case, increasingly cut corners and, in some cases, duped judges in Florida’s overwhelmed court system in the race to foreclose on more people and make more money. (One local judge said a key document filed by a lawyer in Stern’s firm was “fraudulently backdated, in a purposeful, intentional effort to mislead the defendant and this court.”) Stern’s firm, I noted, was among the largest of a thriving breed of law firms profiting off of the housing crisis—and called them “foreclosure mills.”

Days after my 4,600-word investigation into Stern’s operation appeared, the Florida attorney general’s office launched its own probe of three of the state’s largest foreclosure mills. The big banks soon cut ties with Stern, as did Fannie and Freddie. Later, Fannie and Freddie cut ties with all foreclosure mills like Stern’s, after an inspector general report (citing Mother Jones, among others) criticized their use of such firms. Yet through it all, the Florida Bar, the enforcer of ethics for the state’s lawyers, publicly did nothing, to the dismay of homeowners, attorneys, and judges on the other side of Stern’s misdeeds.

No longer. The Palm Beach Post reports that the Bar is looking to bring disciplinary action against Stern resulting from 17 different complaints over the backdating of foreclosure documents, misleading local courts, failing to appear before an appeals court in a class action, and for his attorneys failing to appear in foreclosure hearings. The Bar decided to pursue action against Stern after internal grievance committees—similar to a grand juries—found probable cause in various Bar complaints filed against Stern.

Stern’s attorney, Jeffrey Tew, told the Post that the Bar had already closed 19 complaints against Stern without any repercussions. “David didn’t do anything wrong, ethically or otherwise,” Tew said. “He had a very complete system of supervision and didn’t participate in any of the individual situations.”

There is little left of Stern’s business empire. His law firm shuttered in March 2011 after the banks and Fannie and Freddie yanked their foreclosure cases out of his hands. The next day, DJSP Enterprises, Stern’s short-lived foreclosure processing operation, told investors it would voluntarily delist from the NASDAQ stock exchange. It was quite a downfall for a man whose firm, a few years before, litigated hundreds of thousands of cases for the biggest banks in America, and who was so assured of his abilities and power that he gave T-shirts to investors depicting himself as Superman.

Stern is no longer the Superman of foreclosure lawyers. But for the defense attorneys and homeowners and judges streamrolled by Stern’s foreclosure machine, long-delayed action by the Florida Bar is better than nothing.