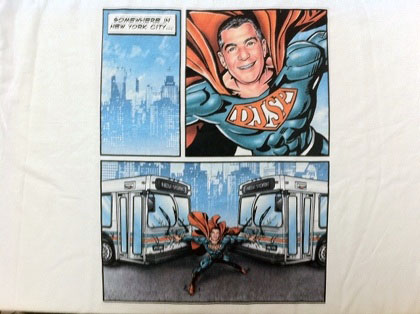

The day after foreclosure attorney David J. Stern announced the closure of his once-powerful law firm, the publicly traded foreclosure processing company he helped create announced plans to delist from the NASDAQ stock market a little over a year after debuting.

In a filing with the Securities and Exchange Commission today, DJSP Enterprises said it will voluntarily drop out of NASDAQ exchange trading by the middle of March. Last winter, the company received notice from NASDAQ that it would be forced to delist unless the company boosted its stock price and maintained a market value of at least $15 million. DJSP’s current market capitalization is a measly $2.6 million, and its stock is hovering around 12 cents a share.

A spin-off of all the foreclosure processing operations of Stern’s law firm, DJSP’s stock opened on the NASDAQ last January at $9.25 a share, with a market capitalization of $300 million. The company’s stock then began to climb, peaking at $13.50 a share in late April 2010. But it all went south a month later, when the company disclosed that it had lost a major chunk of business from a top mortgage company. That admission directly contradicted Stern’s cheery talk about DJSP, investors said. Feeling duped, multiple investors later sued Stern for securities fraud for misrepresenting DJSP’s prospects.

The company’s slide only continued throughout 2010, as media reports—including my investigation into Stern’s firm, published in August—and a Florida attorney general investigation raised serious questions about the allegedly illegal practices of David Stern’s law firm, which was DJSP’s primary source of business.

DJSP’s stock could still be traded but in off-market venues, according to today’s SEC filing. Nevertheless, with the announcement that DJSP is leaving the NASDAQ—presumably before the NASDAQ forcibly delisted the company—the second pillar of Stern’s business empire has crumbled. The downfall of DJSP and the Law Offices of David J. Stern, which will shutter by month’s end, stands in stark contrast with what Stern told prospective investors just one year ago describing the ongoing foreclosure crisis: “So, yeah, we’re in the 2nd inning, but guess what? When we get to the 9th inning, it’s going to be a doubleheader and we got a second game coming.” Turns out, it’s just about game over for Stern.