In the depths of the Great Depression of the 1930s, Congress repealed alcohol prohibition. In the depths of the Great Recession of today, California voters may soon repeal marijuana prohibition. Coincidence? Maybe not. The Socionomics Institute, a Georgia-based think tank, has released a report that finds a relationship between the War on Drugs and the health of the stock market. When the Dow Jones Industrial Average is rising, the federal government typically cracks down on drug use. When it’s stagnant or falling, the government typically relaxes drug controls. “Social mood influences people’s actions and their social judgments,” the report explains. “In times of positive mood, people have the resources to enforce their social desires. They can afford to express black and white social issues preferred during bull markets, and drug abuse is a favorite target.” But during hard times, “people have other, bigger worries and begin to view recreational drugs as less dangerous, if not innocuous in offering stress relief, pain reduction, and the ability to cope with the pressures of negative social mood.” In other words, when the market is low, people just want to get high.

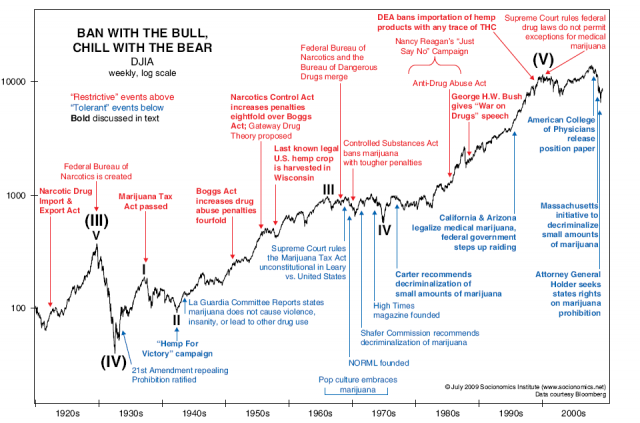

Major events in the War on Drugs pegged to the Dow Jones Industrial Average

(Click on image for larger size)