George W. Bush is not exactly known for his magnanimity—think SCHIP. For American homeowners, especially those facing foreclosure, his aversion to government assistance programs must be particularly vexing. Last year, Bush declared that government should not “bail out… those who made the reckless decision to buy a home they knew they could never afford.” Recently, he has decided that his modest tax rebates for families and businesses are adequate help for squeezed homeowners, and he opposes legislation in Congress that would provide more support.

George W. Bush is not exactly known for his magnanimity—think SCHIP. For American homeowners, especially those facing foreclosure, his aversion to government assistance programs must be particularly vexing. Last year, Bush declared that government should not “bail out… those who made the reckless decision to buy a home they knew they could never afford.” Recently, he has decided that his modest tax rebates for families and businesses are adequate help for squeezed homeowners, and he opposes legislation in Congress that would provide more support.

But despite the rhetoric, there is still one place Bush and his Fed chair are willing to socialize—Wall Street, where investment bank Bear Stearns was bailed out last week. On Monday, the terms of the Fed’s deal with JP Morgan to purchase Bear Stearns assets were readjusted—the Fed is now coughing up only $29 rather than $30 billion—but the American taxpayer still gets a raw deal.

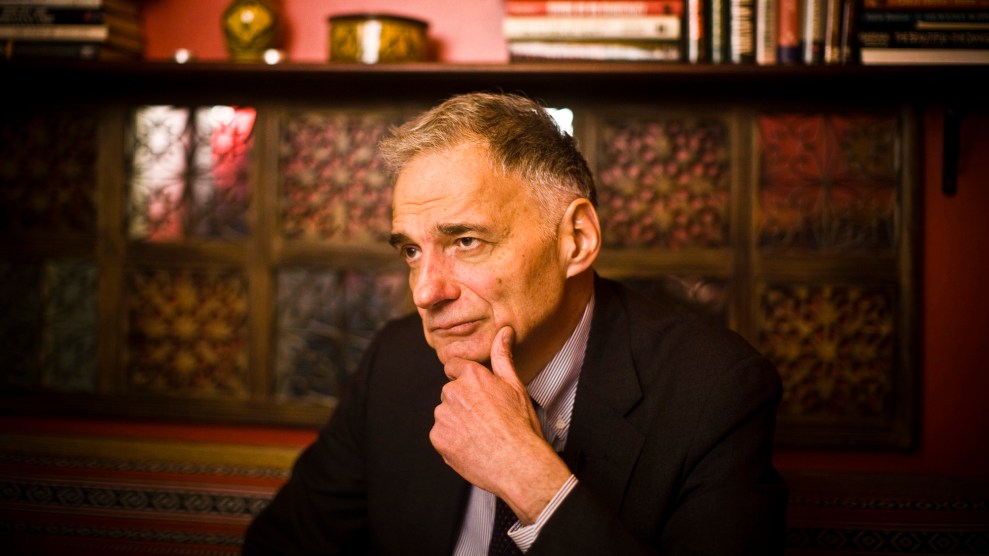

Robert Reich, former Secretary of Labor and a professor at the University of California at Berkeley, argues in his online journal that as taxpayers we should be getting more out of this deal. Nobody, says Reich, knows the actual value of Bear’s assets (the $2 to $10/share price jump is evidence of the guesswork):

“It still may be a good deal for old JP, because the worst that can happen is JP loses $1 billion. If losses turn out to be more than $1 billion, the Fed—that is, you and I and every other American taxpayer—will make it up to JP… We’re bearing the big downside losses if everything goes to hell and Bear’s assets are worth less than zilch. But we don’t get any of the upside gain if any of the bets pay off. That’s what I call a lousy deal…. We as taxpayers are chumps if we bear all the downside losses but get none of the upside gains.”

Today the Senate began to show signs of concern over the deal as well. However, even if we were to get a better deal, in the bigger picture, there’s a real chance that the bailout won’t work at all, that our constricting economy and falling housing prices may actually present a larger problem than the Fed, and our maxed-out consumers, can handle. Reich estimates that investment banks here and abroad are still sitting on several hundred billion dollars of bad debt that will eventually have to surface, meaning more bank failures. Guessing that the Fed won’t be able to ward off all of the ill effects, Reich poses a larger question:

“The next question is how to cushion the blow for middle and lower-income people who might lose their homes or their jobs, cars, medical insurance, and large chunks of their pensions. This may require federally-subsidized insurance—mortgage insurance so homeowners can meet payments, along with expanded unemployment insurance, health insurance, maybe even pension insurance.”

That may be a solution, but given his track record, Bush isn’t likely to sign on anytime soon. In the meantime, perhaps we, or our regulators, should be focusing on feelings of entitlement in Wall Street boardrooms, the land o’ plenty.