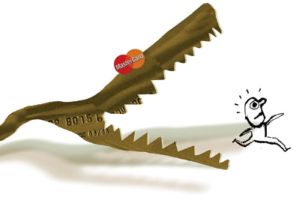

Senator Carl Levin (D-Mich.) chaired an investigations subcommittee hearing on credit cards and the mysteries of how banks determine cardholders’ interest rates—and raise them dramatically without warning. In particular, the hearing focused on banks’ use of “universal default,” by which your card’s interest rate gets hiked up because you missed a payment to another creditor—not the card’s issuer. Or, as the consumer-rights blog The Consumerist puts it, “the most evil and hated practice where a credit card company boosts your rates because you didn’t pay a late fee owed to the library.” Oh, and those new rates apply retroactively to all existing items on your bill. This is one of dozens of sneaky credit-card tricks banks spring on plastic-carrying customers. Levin called three unhappy cardholders to testify, followed by three bank executives. The Consumerist liveblogged all three hours of the fun. A couple of choice moments:

10:16: Onto Millard Glasshof, who has been retired since 1992. He’s here with his wife.

10:16: In 1997 he received a MasterCard with Bank One. He originally agreed in 2004 to payoff a balance of over $5,000 at 14%.

10:17: In March 2005, Chase took over Bank One and bumped the rate to over 17%.

10:18: Millard had never missed a payment. Chase could not explain the increase.

10:19: He received a letter, which he didn’t understand. He thought it said that his new payments were $111. He called to confirm, which Chase did. When he paid $111, Chase hit him with fees for insufficient payments.

10:20: After the Subcommittee looked into his situation, Chase miraculously dropped his rate to 6%.

[…]

11:09: Onto Bruce Hammonds of Bank of America, who sounds like he has the entrails of the poor caught in his throat.

11:09: “We constantly monitor our customer’s behavior.” And you folks worry about government.

11:10: 9%-10% of customers refuse higher rates, close their accounts, and pay off the debt at the old rate.

11:10: Risk-based pricing is good for consumers, says the largest bank in the country.

11:11: Ha! Customers who are re-priced often adopt better financial practices. Right, that’s what happens, BoA. Don’t feel free to provide data.

11:12: Bank of America is arguing that they are a friendly bank, even friendlier than Discover.

11:13: “Customers like our policies.” “We listen to our customers. I personally have spent hundred of hours listening to our credit card customers.”

11:13: “If any of us are wrong, the market will tell us.” (By crashing.)

(H/T Kevin Drum)