Nine years ago Tim Anderson was living the American dream — with a nice house, two cars in the driveway, and a bank consulting firm bringing in over $150,000 a year.

Now Anderson makes $6.50 an hour at Enterprise rent-a-car, moving Buicks from lot to lot. A far cry from the day when he had five people working under him, but the low-pressure job helps him stay focused — and he’s got a lot on his mind.

Since 1987, Anderson, a Libertyville, Illinois banking consultant, has devoted his life to exposing his state’s involvement in the $200 billion savings and loan debacle. Some would call him a hero for giving up such a big chunk of his life, but he’s also been called a nut, Anderson says, by home-state Republican congressman Henry J. Hyde, chairman of the powerful Judiciary Committee, whose S&L dealings Anderson has helped bring to light.

“Illinois was the real center of the savings and loan scandal — not Texas,” Anderson says emphatically. “Going after Henry has been a way of getting Congress to pay attention.”

In 1993, Anderson, a former member of the GOP, told a presidential commission what he knew about the 11-term (and running for a twelfth) Republican’s role in the failure of Clyde Federal Savings & Loan in North Riverside, Illinois. Hyde served as director from 1981 to 1984, and minutes of board meetings show that Hyde seconded the motions of some very reckless investments. By the time Clyde closed in 1991, the thrift had lost $67 million.

Shortly after Anderson’s testimony, the Resolution Trust Corporation decided to sue Henry Hyde and 11 other Clyde directors for the recovery of bailout costs — making Hyde the only congressman being sued by federal bank regulators.

In June, Hyde lost his request to dismiss the $17.2 million lawsuit and since then he’s rejected the government’s subsequent attempts to settle. There is still no date set for the trial.

Anderson hoped the Hyde lawsuit would expose the role the Illinois thrifts played in the national crisis. He hoped to spur the Democrats and the media into investigating a mess that, to Anderson, appeared to be bigger than Whitewater (see “Republican Whitewaters,” Mother Jones, July/August 1996). Anderson imagined congressional commissions, special prosecutors — the works. And then his job would be done.

But Hyde’s lawsuit is three and a half years old, and the S&L bailouts are even older. To make matters worse, Hyde is now a very powerful and popular guy in Washington, chairing the platform committee for the GOP convention in addition to his post on the Judiciary Committee.

“Hyde has gotten a pass from both Democrats and Republicans,” says Anderson. “No one wants to touch him.”

Ironically enough, Hyde’s Republican Policy Committee has been aiding the attempt to draw a connection between the Clintons and failed S&L Madison Guaranty, by releasing a press kit about Whitewater.

Anderson spends hours calling powerful Democrats including Dick Gephardt and Pat Schroeder as well as badgering newspaper editors — trying desperately to keep the story alive.

“People don’t want to hear what he’s talking about,” says Edward Kane, Cleary Professor in Finance at Boston College who has supported Anderson in his investigations. “But it is important in a representative democracy to blow the whistle when there is gross misuse of the taxpayers’ money.”

“When a congressman is sued by the government, that should be a story,” says Anderson. Although the lawsuit has been reported by Roll Call, the Washington Times, and The New Republic, he says many national newspapers won’t touch the story: “USA TODAY and The Dallas Morning News have never acknowledged that Hyde has been sued by his federal government.”

“Basically, their response was ‘Mind your own business,'” he recalls.

Anderson used the Freedom of Information Act to get quarterly thrift reports on a number of institutions, and what he learned wasn’t pretty.

Deregulation had opened a new world of investments to the S&Ls, and Anderson saw evidence of risky, negligent, and even fraudulent loans made by S&L directors out to pocket bonuses from front-end loan fees.

This is greed run amuck, Anderson says, adding that he’s convinced Illinois S&L directors and regulators were in bed together in the mess. Together, Anderson says, they were busy making bad loans to out-of-state S&Ls — at least until the whole mess came tumbling down. Illinois, home of 49 of the 747 S&Ls that failed nationwide, has cost taxpayers $1.5 billion so far, according to 1995 Resolution Trust Corp. figures.

“Chicago was just a real powerhouse for the S&L industry,” agrees Stephen Katsanos, a spokesman for the Federal Deposit Insurance Corp.

Anderson’s S&L work has affected his personal life as well as his professional life. “Three years ago Christmas, my family’s ultimatum was ‘Drop it’,” Anderson recalls. “And I did for about two months.” But he begged them to let his work continue. “It’s my life.”

“It must seem strange that someone would put so much into something that has no payoff,” says Kane. “Except for a strong sense that justice may be served.”

When his quest is finished — getting back into the banking game may be difficult. “When you blow the whistle in this industry you’re treated as if you have leprosy,” he says “It’s a quasi black-balling.”

The costly ineptitude and greed of his peers isn’t what really gets Anderson.

“Who are the victims of the scandal?” he asks unrhetorically. “The people who could have benefited from tax dollars spent on road repairs, flood victims, AIDS research, and drug rehabilitation. The bailout money is doing nothing positive for mankind.”

When asked if any interest in his past has ever rivaled the Illinois S&L scandal, Anderson replied, “That’s like asking Ralph Nader, ‘Before cars…what bothered you?'”

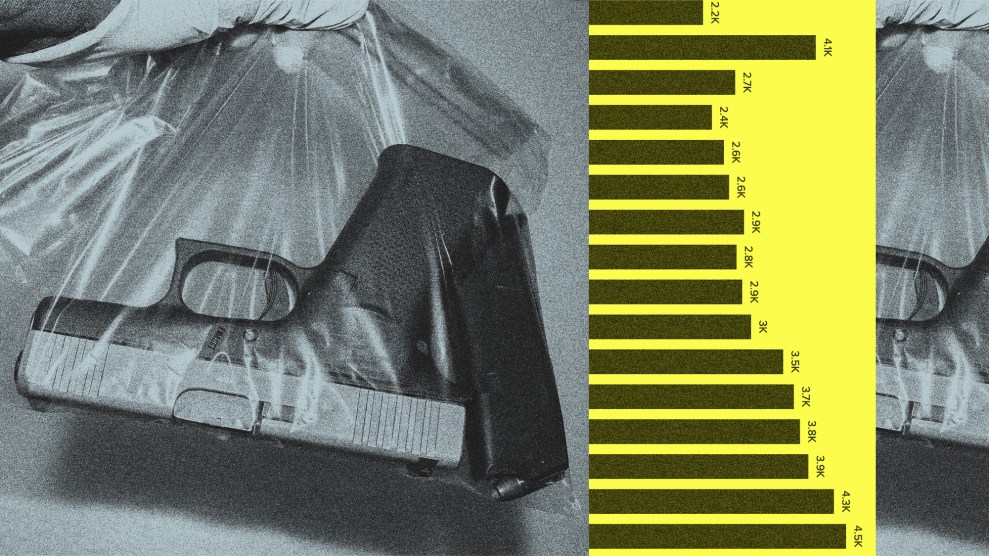

Laura Linden is a MoJo Wire Intern. Leslie Weiss is a free-lance writer. Photo-illustration by Denise Alvidrez.

Update: A National Review editor wants Hyde to fill Newt’s shoes.