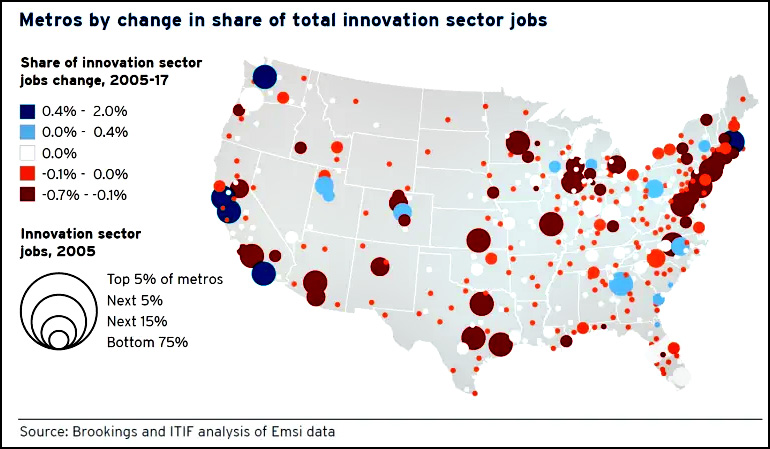

A team of researchers at Brookings and the Information Technology & Innovation Foundation (ITIF) has a new white paper out that says virtually all the growth of high-tech jobs during the past decade has happened in five metro areas: Seattle, San Jose, San Francisco, San Diego, and Boston. The big blue circles in the map below tell the story:

In addition to the Big Five, there are also a Medium Five: Salt Lake City, Denver, Atlanta, Raleigh, and Pittsburgh. Beyond that, there are lots of small cities that are treading water and a vast number of large cities that are losing tech jobs. The authors believe this is something of a catastrophe, and they have an idea:

Such high levels of territorial polarization are a grave national problem….Whole portions of the nation may now be falling into “traps” of underdevelopment—and that is creating baleful social impacts….Regional divergence is also clearly driving “backlash” political dynamics that are exacerbating the nation’s policy stalemates.

….The nation should counter regional divergence by creating eight to 10 new regional “growth centers” across the heartland….Along these lines, the federal government should:

- Assemble a major package of federal innovation inputs and supports for innovation-sector scale-up in metropolitan areas distant from existing tech hubs. Central to this package will be a direct R&D funding surge worth up to $700 million a year in each metro area for 10 years. Beyond that will be significant inputs such as workforce development funding, tax and regulatory benefits, business financing, economic inclusion, urban placemaking, and federal land and infrastructure supports.

A rough estimate of the price of such a program suggests that a growth centers surge focused on 10 metro areas would cost the federal government on the order of $100 billion over 10 years. That is substantially less than the 10-year cost of U.S. fossil fuel subsidies.

- Establish a competitive, fair, and rigorous process for selecting the most promising potential growth centers to receive the federal investment. A new growth center program would select for awards the eight to 10 metropolitan areas that had best demonstrated their readiness to become a new heartland growth center.

The authors think they have identified 35 candidate for this slush money, and they would all compete via a “a rigorous competition characterized by an RFP-driven challenge, goal-driven criteria, and an independent selection process.” I’m willing to bet it would be driven more by which cities are favored by powerful congressional committee chairs, but perhaps I’m being too cynical about it?

In any case, is it really possible to create thriving tech centers with a modest incentive budget of $700 million per year per city? That doesn’t strike me as an awful lot, especially when you consider that Amazon turned down cities offering upwards of $7 billion just to build a second headquarters there. Plus there’s the problem that a lot of states are left completely out of this money hose: Texas, Georgia, Virginia, Delaware, Maryland, Nevada, Oklahoma, Colorado, and nothing in either New England or the vast upper Mountain states.

I guess it will all get worked out. But first we need a congress where a majority of the members are aware of what an “app” is and why there’s more to building a computer in the US than just ordering up the right parts from Best Buy. It also might help if they had even the dimmest understanding of what Apple, Microsoft, Facebook, Amazon and Google actually do.