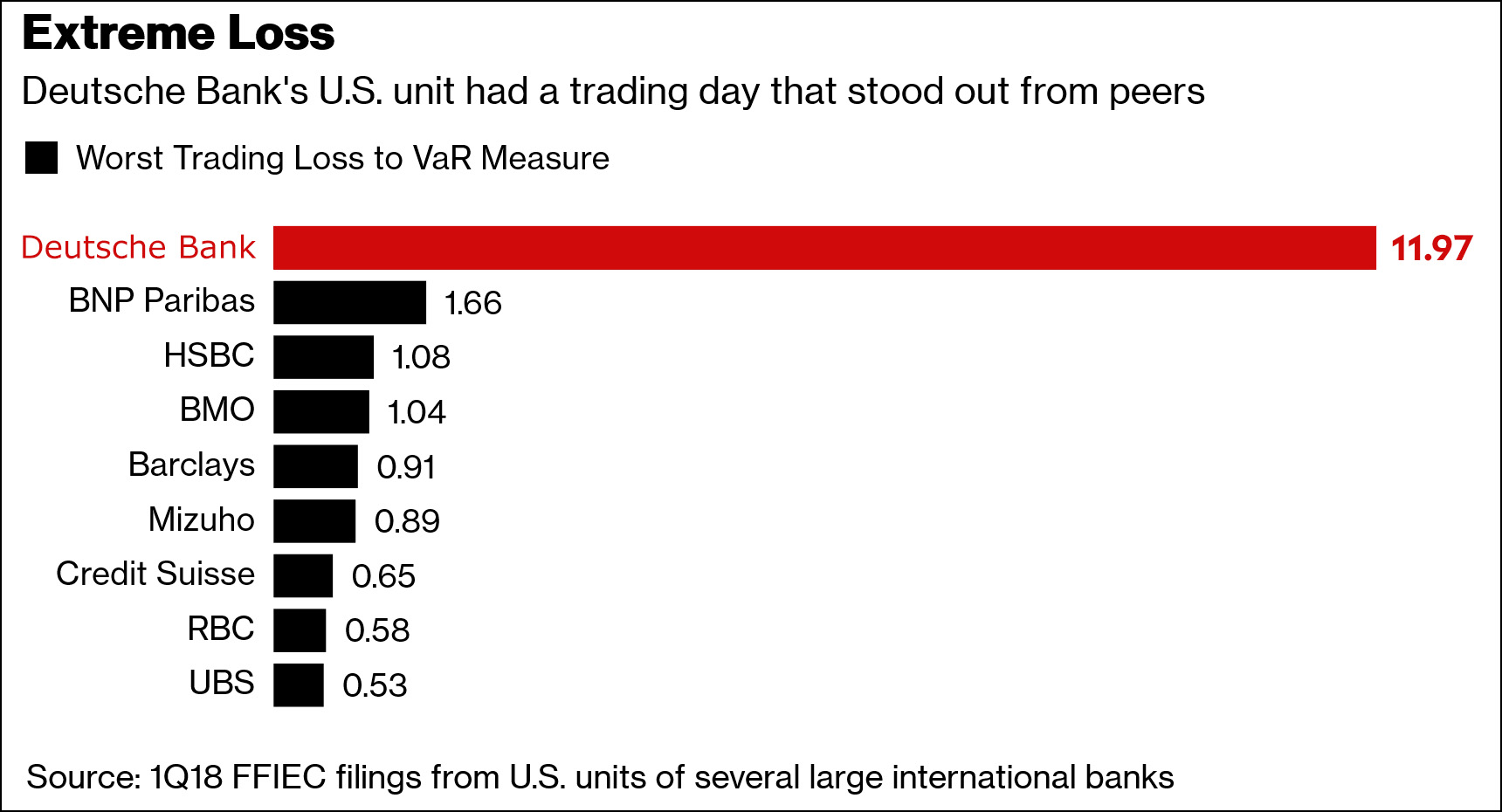

Bloomberg reports that in the first quarter of 2018 Deutsche Bank had a single day in which they suffered losses of nearly 12 times VaR:

VaR stands for Value at Risk, and it’s a measure of the maximum loss a portfolio is likely to sustain under normal circumstances. Exceeding VaR moderately once a quarter is not too unusual. Nearly everyone probably does it once a year. But:

The extreme day was one of four in the first quarter in which Deutsche Bank’s U.S. traders had a loss that surpassed the firm’s regulatory VaR estimate. No other bank required to file quarterly reports with the Fed detailing significant trading activities had more than two such days, and none had a daily loss that even doubled its estimate, according to a review of the 33 filings from U.S. lenders and the local units of foreign firms.

How unlikely is this? VaR is typically not a bell curve, but we can start there. As near as I can tell, VaR is normally two standard deviations, meaning you’d expect to exceed VaR—by a little bit—perhaps 2 percent of the time, or maybe a few days per year. Deutsche Bank’s bad day was 12x VaR, which is 24 standard deviations. That’s like having an IQ of 500. You’d expect to it to happen…

…well, if my calculation is correct, you’d expect it to happen once every 10127 days. Just for reference, the universe is a piddling 1010 days old. But we’re not dealing with a bell curve, so let’s divide by a bazillion, which gets us back to, oh, let’s be generous and say 1050 days. That’s still a billion trillion quadrillion gazillion times the age of the universe. So this leaves us with two possibilities:

- Holy cow, Deutsche Bank got really unlucky.

- Deutsche Bank’s VaR model is really, really bad.

I’m going with Door #2. That said, even a bad model shouldn’t be off by this much. It’s possible that Deutsche Bank’s VaR model might now hold the record for worst financial model in the history of the world. They should be proud.