Republicans said their big tax cut would spur corporations to invest more and give their employees big raises. Everybody else said it was far more likely that corporations would spend most of the money on stock buybacks, which would increase the value of stock owned by CEOs and wealthy investors. It looks like everybody else was right:

Almost 100 American corporations have trumpeted such plans in the past month. American companies have announced more than $178 billion in planned buybacks — the largest amount unveiled in a single quarter, according to Birinyi Associates, a market research firm.

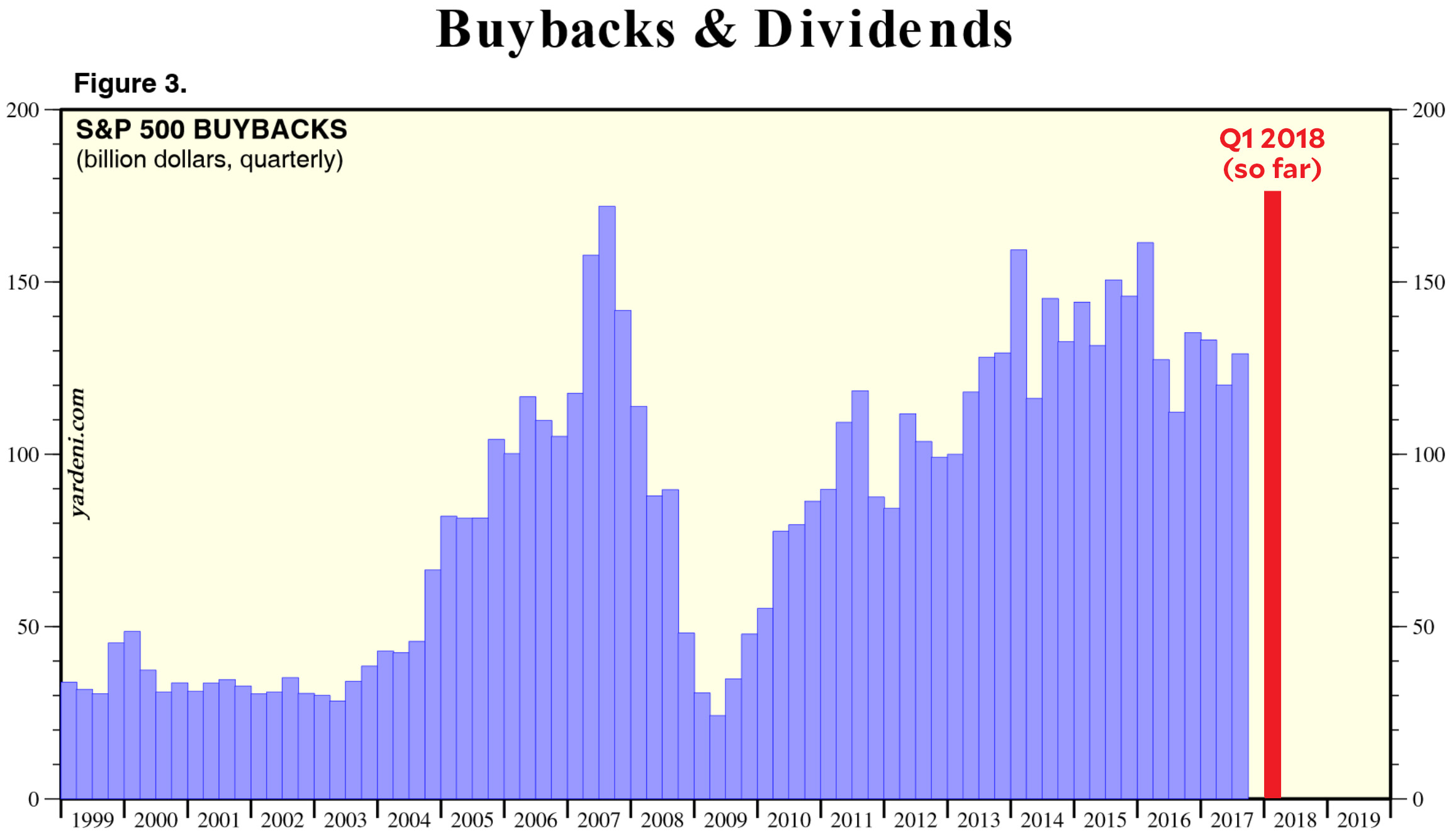

Let’s put that in perspective by comparing it to buybacks over the past few years:

As you can see, buybacks have been on a generally downward trend since 2015. But in the first two months of 2018 they’ve already spiked to their highest level ever, beating even the peak of the housing bubble. By the time the quarter is over, buybacks will have not just set a new all-time record, but will have blown past it:

More buybacks are almost certainly on the way….“I’m expecting buybacks to get to a record for 2018,” said Howard Silverblatt, a senior index analyst with S.&P. Dow Jones Indices. “And if I’m disappointed, there’s a lot of people with me.”

….The vast majority of the billions of dollars in planned share purchases will benefit the richest 10 percent of American households, who own 84 percent of all stocks. The top 1 percent of households own about 40 percent of all stocks. Ultimately, the effect of the rising stock market depends on how those wealthy investors use their windfall. It helps the economy more, for example, if they put the money toward productive new companies than if they invest in government bonds.

This is exactly what happened the last time corporations got a big tax cut, so it’s hardly a surprise. Republicans fully expected this, and all their blather about “capital formation” and “$4,000 in wage growth” was just the usual smokescreen to justify a giveaway to the rich. Back in October, CEA head Kevin Hassett said “I would expect to see an immediate jump in wage growth.” Today he’s singing a different tune: “Right now we’re going to have an adjustment where you see probably more dividends and share buybacks than wage increases.” Wage growth will come later.

You betcha. We’ll be seeing those fatter paychecks any day now.

Corporations and the rich were willing to cover their ears and support Donald Trump because they knew it would make them even richer. That’s paid off for them. I hope they’re happy.