One of the great things about FRED is its unpredictability. There are lots of things you’d think they’d have, but they don’t. For example, apparently the Census Bureau doesn’t play nice, which means FRED has no Census data on wages or trade deficits. This is especially annoying because the Census data is an unholy pain in the ass, especially for trade data. Bad Census Bureau!

On the other hand, it’s also got great stuff you can find by accident. I happened to do a search with the string “coin” in it, and got back total orders for $1 coins from the US Mint:

No one wants $1 coins. There are over a billion of them in reserve, just waiting for banks to order them. But total orders add up to only about 60 million per year—mostly for birthday presents to small children, I imagine. Until we get rid of the one-dollar bill, the one-dollar coin has no audience.¹

On a more serious note, I also ran into this chart showing the velocity of money:

I don’t really know what this means. More accurately, I know what it means—a single dollar circulated an average of 2.2 times per year in 1998 but only 1.4 times in 2017—but I’m not sure what it implies. Certainly it corresponds to lower inflation. But what else? And why has velocity been slowing down pretty steadily for nearly 20 years? This is yet another economic variable that took a sharp downward turn right around 2000, and that always interests me. There’s an awful lot of these inflections in 2000, and I really want to know what happened in 2000 to cause it.

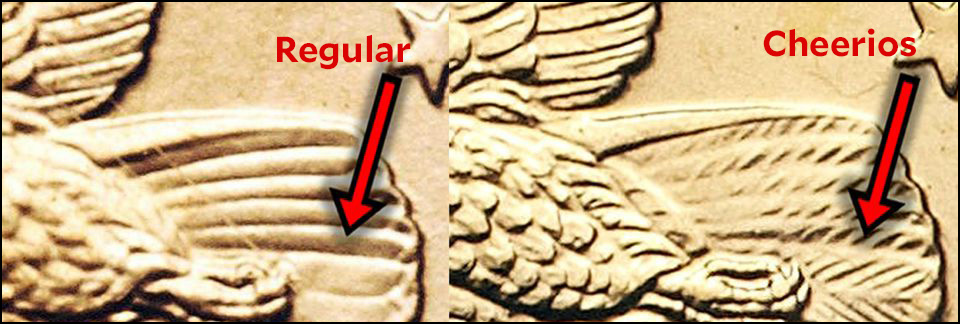

¹On the bright side, the “Cheerios” version of the 2000 dollar coin is extremely valuable. Why is it called “Cheerios”? Because 5,500 of them were included in boxes of Cheerios, dummy. But that’s not enough to make them valuable. It turns out that the Cheerios giveaways were struck from a slightly different master die, which means they’re easily identifiable and there are only 5,500 of them. If you got one and tossed it into a drawer, get it out and sell it. You’re rich!