President Trump is ready to start signing executive orders that roll back Obama-era regulations on climate and water pollution:

While both directives will take time to implement, they will send an unmistakable signal that the new administration is determined to promote fossil-fuel production….One executive order — which the Trump administration will couch as reducing U.S. dependence on other countries for energy — will instruct the Environmental Protection Agency to begin rewriting the 2015 regulation that limits greenhouse-gas emissions from existing electric utilities. It also instructs the Interior Department’s Bureau of Land Management (BLM) to lift a moratorium on federal coal leasing.

….Trump, who signed legislation last week that nullified a recent regulation prohibiting surface-mining operations from dumping waste in nearby waterways, said he was eager to support coal miners who had backed his presidential bid. “The miners are a big deal,” he said Thursday. “I’ve had support from some of these folks right from the very beginning, and I won’t forget it.”

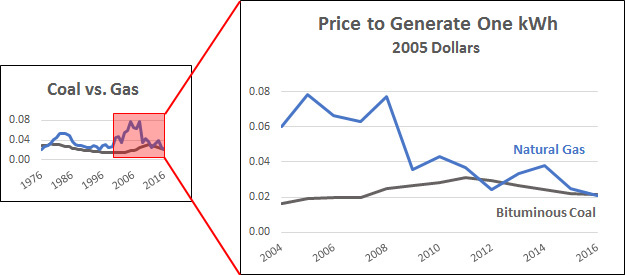

Will this put miners back to work? Not really, for a simple reason: bituminous coal is only barely competitive anymore with natural gas:1

Bituminous coal is the stuff that’s mined in Appalachia and the Eastern US. It’s what you think of when you think of coal miners. However, it’s faced price pressure for decades from surface-mined subbituminous coal produced with minimal labor in Wyoming and the rest of the West,2 and now it’s facing price pressure from natural gas too. Natural gas prices spiked in the aughts, partly due to Hurricanes Katrina and Rita, and just as those spikes began to subside naturally, hydraulic fracturing opened up vast new quantities of natural gas, forcing the price to plummet. Right now, natural gas is only a hair’s width away from being cheaper than coal.

Can Trump do anything about this? No. He can repeal all the rules he wants, but returning to, say, the 2014 price of coal just won’t make much difference. The price of natural gas is still going be competitive with, or lower than, bituminous coal—and a lot cleaner too. Besides, Trump also plans to ease rules on fracking, which will push the price of natural gas down too. Coal miners are unlikely to benefit from all this by any appreciable amount.

So who will? As usual, the answer is coal mine operators. The repeal of environmental rules won’t affect prices enough to make much difference in coal employment, but it will provide a nice chunk of pocket change for the folks who own the mines.

UPDATE: The EIA conversion factor I used for the amount of natural gas to produce 1 kWh is based on the average efficiency of steam and combustion turbine plants. However, combined cycle plants account for about half the gas fleet, so the average efficiency of natural gas plants is a bit higher than the EIA numbers suggest. I’ve modified the chart to account for this.

1Historical price of bituminous coal here. Recent price history here. Natural gas prices here. Conversion factors to kilowatt-hours here, reduced by about 12 percent to account for the fact that efficient combined-cycle plants make up about half the gas fleet. I’ve done a bit of massaging here and there in the recent data to make the entire series comparable. Nonetheless, these figures are still slightly approximate, especially for coal, which varies in price fairly widely depending on region and type.

2Wyoming produces 40 percent of all US coal but employs only about 7,000 workers.