For reasons that are a little unclear, Rep. Sam Johnson (R-Texas) has decided to introduce a shiny new plan to reform Social Security when Congress meets next year. Johnson’s idea of “reform” is to slash everyone’s benefits, so this idea seems slightly suicidal—not to mention pointless, since Donald Trump campaigned very loudly on a promise not to touch anyone’s Social Security.

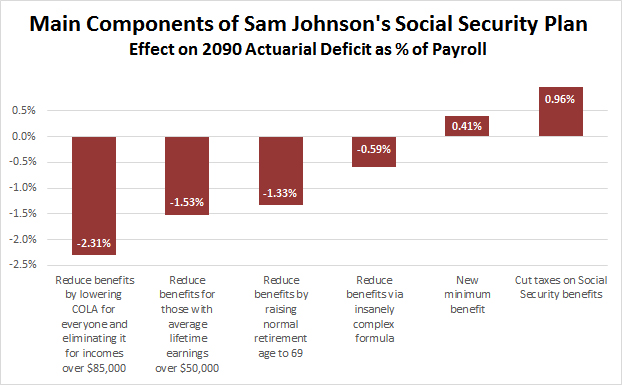

But Johnson is a very conservative guy, and maybe he just wants to lay down a marker. So what would his plan do? It has 15 components, all of them crammed full of Social Security’s usual alphabet soup of acronyms—AWI, PIA, AIME, MAGI, bend points, etc.—but it turns out that only six of them are big enough to be meaningful. Here is the Social Security actuary’s estimate of how much money they’d save:

Basically, there are four big proposals that would cut benefits by 5.76 percent of payroll, and two proposals that would increase benefits by 1.37 percent of payroll. I assure you that this chart is far simpler to understand than the actual analysis, but it probably still leaves you a little baffled. Whose benefits would be cut? And by how much? I’m here to help:

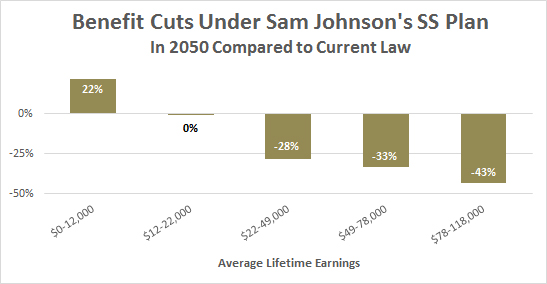

Roughly speaking, people with extremely low average earnings over their working lives would see their benefits rise. That’s good! Unfortunately, everyone with an average lifetime income over $22,000 would see their benefits slashed—in some cases by a lot. An income of $60,000 is not exactly a king’s ransom, but nonetheless Johnson would cut benefits for these folks by a third.

As usual with these plans, a lot of its provisions are phased in gradually over time. But unlike most of these plans, some of them start to kick in right away. This means that even people who are already retired would suffer benefit cuts. For example, Johnson’s plan reduces the annual cost-of-living increase—and eliminates it entirely for anyone earning over $85,000—beginning in 2018.

Anyway, since I tortured myself by reading this plan, I figured I should torture all the rest of you by blogging about it. Happy Holidays!