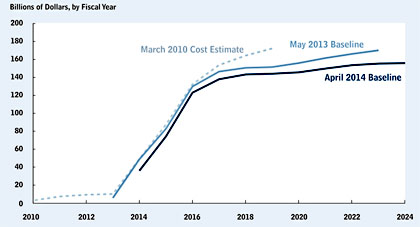

The CBO released a small bit of good news/bad news about Obamacare today. The good news: they now estimate that the 10-year cost of the program will be $104 billion less than they previously thought—which, in turn, was less than they had projected in  2010. This is primarily because exchange premiums have come in lower than CBO originally estimated, which means that federal subsidies will be lower.

2010. This is primarily because exchange premiums have come in lower than CBO originally estimated, which means that federal subsidies will be lower.

The bad news: the lower cost of premiums is primarily because the quality of the plans coming from insurers is lower than CBO originally estimated: “The plans being offered through exchanges in 2014 appear to have, in general, lower payment rates for providers, narrower networks of providers, and tighter management of their subscribers’ use of health care than employment-based plans do. Those features allow insurers that offer plans through the exchanges to charge lower premiums (although they also make plans somewhat less attractive to potential enrollees).”

CBO didn’t update its projection of Obamacare revenues, but if those don’t change, it means that Obamacare will reduce the deficit even more than we thought.

But here’s an interesting thing: CBO continues to project that Obamacare will lead to no short-term change in employer-based insurance. But the latest Rand poll suggests that employer insurance has increased by about 7 million since Obamacare enrollment started up last year. If that number turns out to be real, I wonder how that will affect CBO’s budget estimates? It all depends on how this feeds into their models, but it seems like it would be a positive thing one way or the other.