Today’s email brings word of an interesting new paper from Bhashkar Mazumder of the Chicago Fed and Sarah Miller of Notre Dame. They set out to measure the effect of the Massachusetts health care reform on bankruptcy and personal debt, a subject that’s topical for a number of reasons:

- The Massachusetts plan is quite similar to Obamacare, so results from this study are suggestive of the impact that Obamacare will eventually have.

- One of the primary purposes of universal health insurance is to relieve the financial stress of large unpaid medical bills.

- Massachusetts is a good case study because its reform affected everyone, not just those below the poverty line.

The authors take advantage of the fact that health care reform had bigger effects on some groups than others. Most middle-aged people, for example, were already insured, so the Massachusetts reform affected them only modestly. Conversely, young people had relatively low insurance rates, so they were more heavily affected. Ditto for counties, some of which had higher initial rates of uninsurance than others.

The study exploits a very large data set of consumer finance based on reporting from credit bureaus, which provided a sample of nearly 400,000 individuals to look at. Its conclusion is unsurprising:

We find that the reform significantly improved credit scores, reduced the total amount past due, reduced the fraction of debt past due, and reduced the probability of personal bankruptcy. We find particularly pronounced reductions in the probability of having a large delinquency of over $5,000. These effects tend to be larger among individuals whose credit scores were low at the time of the reform, suggesting that the greatest gains in financial security occurred among those who were already struggling financially.

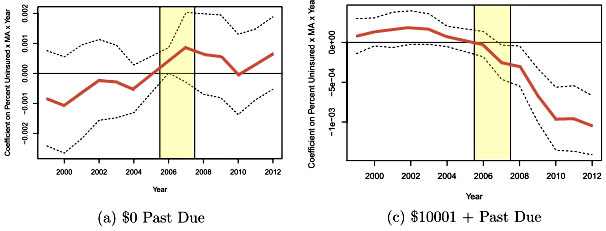

The charts below, excerpted from the study, illustrate the effect of health care reform, which was implemented in the period shown by the yellow bars. Despite the severe recession that followed, the amount of current debt stayed pretty flat while the amount of debt more than $10,000 past due declined sharply. Obamacare is not as universal as the Massachusetts reform, so its effects will probably be less pronounced. Nonetheless, it will not only provide routine health care for millions of Americans who aren’t currently getting it, it will also make their lives far less financially precarious. That sounds like a win to me.