Normally, my blog whining produces no results worth mentioning. But last month was different: two, count ’em, two of my whines got results. This is easily a new personal best.

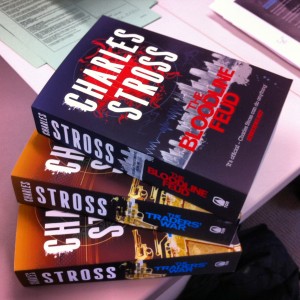

First up: I complained bitterly that Charlie Stross’s newly revised Merchant Princes series was available in Britain but not in the US. I understand why the publishing schedule for the  physical books might be off in the future, but why not release the e-versions? Well, the estimable Patrick Nielsen Hayden of Tor Books heard my lament and sprung into action. As a result, digital versions of these books will be available in the United States next Tuesday, January 7. Details and links here.

physical books might be off in the future, but why not release the e-versions? Well, the estimable Patrick Nielsen Hayden of Tor Books heard my lament and sprung into action. As a result, digital versions of these books will be available in the United States next Tuesday, January 7. Details and links here.

Second: I expressed surprise that no one was talking yet about Thomas Piketty’s new book, Capital in the 21st Century. Sure, it’s only available in French at the moment, but there must be at least a few economists who read French and have something to say about it. Right? Well, Brad DeLong, who (a) reads French, (b) also happens to have on hand a manuscript of the English translation, and (c) has read the PowerPoint notes for a lecture Piketty gave based on his book, provides us with a synopsis of Piketty’s findings:

- As growth rates decline in the Old World (Europe and Japan), we will once again see the dominance of capital: a greater proportion of the wealth of society will be held in the form of physical and other non-human-skill assets, and inheritance and position will matter more and individual effort and luck less.

- In fact, given relatively high average rates of return on capital and thus a large gap vis-a-vis the growth rate, wealth concentration is likely to reach and then surpass peak levels seen in previous history as the superrich become those who started wealthy and benefitted from compound interest and luck.

- America remains an exceptional puzzle: it looks, however, like it is headed for an even more extreme distribution of wealth than is the Old World.

- Remember, however: the evolution of income and wealth distributions is always political, chaotic, unpredictable–and nation-specific: not global market conditions but national identities rule wealth distributions.

- High wealth inequality is not due to any “market failure”: this is a market success: the more frictionless and distortion-free are capital markets, the higher will wealth inequality become.

- The ideal solution? Progressive global-scale wealth taxes.

There’s much more at the link, including the complete set of slides from Piketty’s talk. Or you can wait until March when the English translation comes out and everyone dives in.

I am excited that my end-of-year whining has produced such stunning results. All that’s left is to figure out if this is just a coincidence, or if my whining has somehow become more effective lately. Perhaps I should whine more to find out?