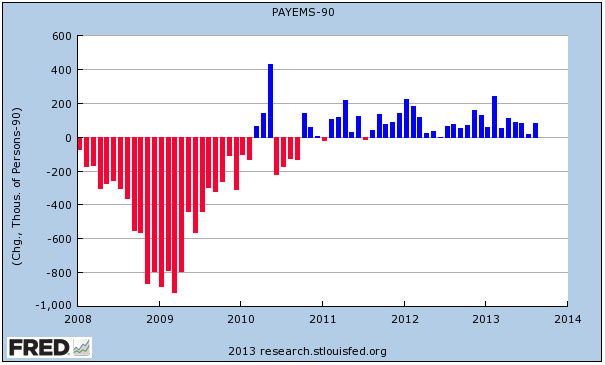

The American economy added 169,000 new jobs last month, but about 90,000 of those jobs were needed just to keep up with population growth, so net job growth clocked in at 79,000. That’s about the same as last month—except for the fact that last month’s numbers got revised sharply downward today. Net job growth in July was reduced from 72,000 to 14,000, barely the breakeven point, and just for good measure, June’s numbers were revised down a bit too.

The headline unemployment number declined slightly to 7.3 percent, but for the worst possible reason. It’s not that more people were at work in August. In fact, fewer people were employed than in July. Normally this would produce a lower employment rate (and therefore a higher unemployment rate), but because lots of people exited the labor force entirely, the size of the civilian labor force dropped by 312,000 people. Here’s how the employment arithmetic works out:

July: 144,285 / 155,798 = 92.61%

August: 144,170 / 155,486 = 92.72%

So there are fewer people working, but because the size of the labor force dropped so much, the employment rate actually went up by a tenth of a point. Likewise, the unemployment rate went down by a tenth of a point.

The question is why the labor force shrank. As it turns out, it’s not because there were more discouraged workers. There were fewer. Nor were there more people forced into part-time work because of the bad economy. There were fewer. There were more people who switched to part-time work for noneconomic reasons, but presumably that doesn’t reflect one way or the other on the state of the economy.

It’s a little bit mysterious, and maybe someone with better economic chops will explain it all later in the day. In the meantime, there’s one takeaway from this that’s simple: This is a really weak jobs report. It’s crazy that we’ve all but given up on both monetary and fiscal policy designed to fight this weakness.