One of the longstanding arguments about our sluggish recovery from the Great Recession is whether it’s mostly cyclical or mostly structural. If it’s cyclical, that basically means it’s a matter of depressed spending. If the Fed and Congress would just pump enough money into the economy to stimulate demand, that would kickstart us back into a stronger recovery.

But if it’s structural, that won’t work. A structural problem, for example, would be an economy that needs lots of computer programmers, but instead finds itself with too many construction workers thanks to the housing bubble. You can’t easily train construction workers to be computer programmers, so even if you stimulate demand you’re still going to have a big unemployment problem.

Neil Irwin points out today that it’s been hard to find evidence for the story of structural problems. If certain occupations were in desperate need of workers they couldn’t find, wages in those occupations would skyrocket. But they haven’t. Likewise, if it were a matter of too many workers in, say, California, and too few in Texas, you’d expect wages in Texas to go up. But that hasn’t happened either. With a few small exceptions, wages have stayed depressed in all occupations and all regions.

So now a team of Fed economists has taken a different approach to slicing and dicing the data: Maybe the problem is actually a broad mismatch between the supply and demand for workers who can do complex, nonroutine jobs. But they took a look, and their basic answer is no: the Great Recession has hit both routine and nonroutine occupations about the same.

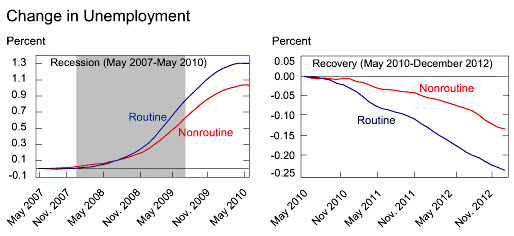

I accept this. And yet, the data from the Fed study doesn’t back up their theory completely. For example, here’s a pair of charts showing the change in unemployment rates:

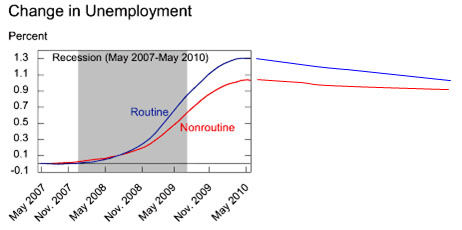

That’s a little hard to read, though. Here’s a rough re-charting of their data using equal units for the entire period from 2007 through 2012:

It’s true that routine jobs have recovered a little better than nonroutine jobs, but they’ve still done worse overall. And their other charts show a similar trend: before the recession, there was no difference at all between routine and nonroutine jobs. Since then, a persistent gap has appeared. It’s a small gap, but it’s there.

And this is just a guess on my part, but I suspect that routine workers have dropped out of the workforce at a greater rate than nonroutine workers, which means they don’t show up in unemployment statistics at all. Some of them go on disability, some of them stay home with the kids, some of them retire early, and some just plain give up and don’t have any income.

For what it’s worth, I also have some issues with their definitions of routine vs. nonroutine. But that’s obviously a very tricky thing, and I certainly haven’t taken a close look. So I’ll set that aside for now.

Generally speaking, I think this study is valuable: it shows, more broadly than some previous studies, that the aftermath of the Great Recession is primarily cyclical, not structural. That means we could fix most of it if we quit obsessing over budget deficits in 2030 and instead focused on proper fiscal and monetary policy right now. My only caution is that I don’t think this study shows that our problem is entirely cyclical. It really does look to me like the Great Recession opened up—or perhaps exposed—a structural gap that’s a bit larger than it used to be. It’s not a lot bigger, but it’s there.