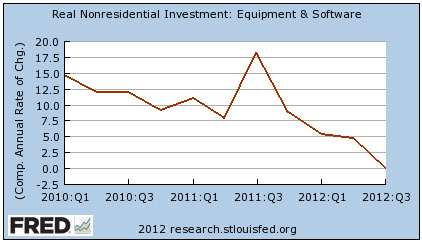

In his column today, Neil Irwin quotes the CEO of AT&T claiming that “uncertainty” over the fiscal cliff is restraining business growth. This is a common claim, but Irwin correctly points out that “a slowing in business spending took effect long before the term ‘fiscal cliff’ had even been coined.” He’s right. But just saying this doesn’t make it clear just how dramatic the slowdown has been. As you can see in the chart on the right, business investment growth has been on a clear downward slope for the past three years. This obviously has nothing whatsoever to do with fear of the fiscal cliff.

In his column today, Neil Irwin quotes the CEO of AT&T claiming that “uncertainty” over the fiscal cliff is restraining business growth. This is a common claim, but Irwin correctly points out that “a slowing in business spending took effect long before the term ‘fiscal cliff’ had even been coined.” He’s right. But just saying this doesn’t make it clear just how dramatic the slowdown has been. As you can see in the chart on the right, business investment growth has been on a clear downward slope for the past three years. This obviously has nothing whatsoever to do with fear of the fiscal cliff.

I’m a cynic, so I suppose you should take my views on the business community with a shaker of salt. Nonetheless, here’s what I think we should conclude from this: Fortune 500 CEOs should never be taken seriously on macroeconomic issues. Their job is to dole out high-grade BS in public, and politics and macroeconomics are just grist for their mill. Every word out of their mouths is special pleading, and that’s how the business press ought to treat it. I really have no idea why anyone ever takes them seriously on this stuff.