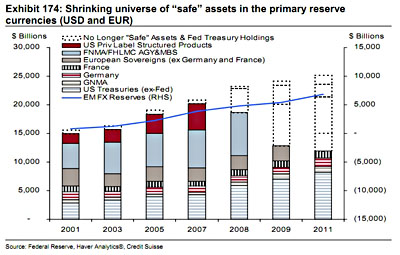

Alphaville’s Cardiff Garcia calls this the most important chart in the world, and maybe it is. (Though there are lots of competitors for that title these days.) It shows the precipitous drop in the stock of safe, AAA-rated assets from its 2007 peak of about $20 trillion to roughly $12 trillion this year. In one sense, you could say this is a good thing: at least we’re no longer pretending that risky assets aren’t, in fact, risky assets. Unfortunately, the availability of safe assets is pretty important to the smooth functioning of modern finance because they’re necessary as collateral in the repo market:

Alphaville’s Cardiff Garcia calls this the most important chart in the world, and maybe it is. (Though there are lots of competitors for that title these days.) It shows the precipitous drop in the stock of safe, AAA-rated assets from its 2007 peak of about $20 trillion to roughly $12 trillion this year. In one sense, you could say this is a good thing: at least we’re no longer pretending that risky assets aren’t, in fact, risky assets. Unfortunately, the availability of safe assets is pretty important to the smooth functioning of modern finance because they’re necessary as collateral in the repo market:

When you hear concerns that the ECB has lost some control over monetary policy because of a liquidity-starved credit channel — or indeed when you hear Draghi himself say that he’s cognizant of the “scarcity of eligible collateral” — this is why.

….A somewhat obvious and related point here, but the loss of “safe” status for so much debt contributes to the deleveraging burden of European banks and their American subsidiaries; by definition it means higher risk weightings for these assets.

Declining asset quality is surely also one reason that European banks had trouble funding themselves in US repo markets, and the resulting stress in the currency basis swap markets as banks sought dollars elsewhere led to last week’s intervention.

This is bad for Europe, of course, and as we discussed a couple of weeks ago, there’s reason to think that deleveraging among European banks could have a pretty serious impact on American credit markets too. We may or may not like much of what the shadow banking system does, but there’s no question that it plays a key role in sustaining bank lending, and the repo market is its backbone.

In other words, just another thing to worry about. I wouldn’t want this morning’s semi-optimistic post about Europe to get you too excited or anything.