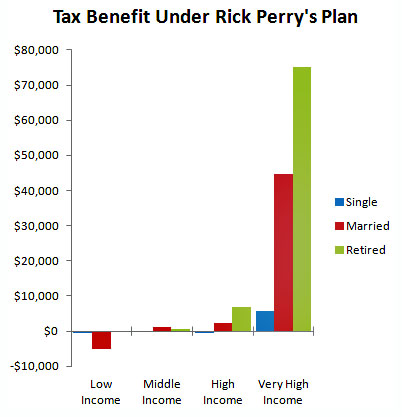

Yesterday I proposed that we all spare a thought for whichever poor analyst at the Tax Policy Center got drafted to make sense of Rick Perry’s flat-tax plan. Now we have a name: Roberton Williams, a senior fellow at TPC who crunched some numbers at the behest of the New York Times’ Catherine Rampell. The chart on the right summarizes his handiwork.

Yesterday I proposed that we all spare a thought for whichever poor analyst at the Tax Policy Center got drafted to make sense of Rick Perry’s flat-tax plan. Now we have a name: Roberton Williams, a senior fellow at TPC who crunched some numbers at the behest of the New York Times’ Catherine Rampell. The chart on the right summarizes his handiwork.

As you can see, low-income taxpayers mostly do better under the current tax system. Middle-income taxpayers vary. High-income taxpayers mostly do better under Perry’s plan. And very high-income taxpayers make out like bandits under Perry’s plan.

No surprise there. What’s underappreciated, though, is that this means the rich not only pay lower taxes, they also benefit from having simpler taxes. They do so much better under Perry’s plan that they’ll almost all just fill in his postcard without even bothering to calculate how much they might owe under the current regime.

Low and middle-income taxpayers, however, have no such luck. There’s a pretty good chance they’ll do better under the current system, which means they need to fill out Perry’s postcard and fill out a current 1040 to see which one comes out better. No simple taxes for them.

In more ways than one, it’s good to be rich in Rick Perry’s America.

UPDATE: James Pethokoukis passes along a revenue analysis from John Dunham and Associates that was commissioned by the Perry campaign. It that says Perry’s tax plan would raise $4.7 trillion less than current law over the six years from 2014-2020. Hello, bigger budget deficits! Under a dynamic scoring method that assumes Perry’s plan would supercharge the economy, it would raise $1.7 trillion less. Of course, dynamic scoring is mostly a scam, so something in the range of $4 trillion is probably in the ballpark.