Ezra Klein remarks today on the fact that critics of President Obama’s deficit plan claim that much of his savings are “fake.” That is, they’re savings that were going to happen anyway, so his plan doesn’t really change anything:

But that means that more than a trillion dollars of our projected deficit is “fake.” That money can’t be real on one side of the ledger and fake on the other. In general, this mostly speaks to the flaws of talking about deficits in terms of dollar figures rather than debt-to-GDP ratios.

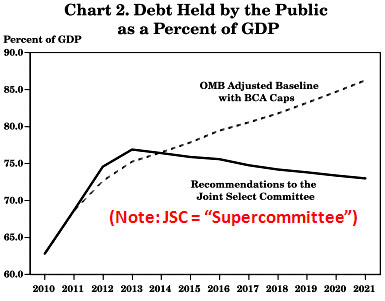

The real question for the president’s plan — or any plan — is whether it stabilizes the debt-to-GDP ratio at an acceptable level. If so, then it’s good enough. If not, then it’s not. That’s what the market cares about, and that’s what we should care about. According to the White House’s projections, their plan will leave debt-to-GDP at slightly above 70 percent in 2012.

Good point. The savings are either real or they’re fake, and if they’re fake they shouldn’t be counted to begin with. Of course, that would mean that our existing deficit situation is less  dire than it appears, and that would be inconvenient for the Chicken Littles.

dire than it appears, and that would be inconvenient for the Chicken Littles.

In the end, Ezra is right: who cares? Either the budget gets into primary balance (i.e., not counting interest payments) in a suitable time frame or it doesn’t. If it does, everything is fine and it really doesn’t matter much which baseline you used to calculate things. And as you can see on the right, the Obama administration projects that their plan will reduce the country’s debt-to-GDP ratio consistently from 2014 forward. You may or may not believe that this is actually going to happen, but that’s a political judgment. If Congress actually enacts the president’s plan, then our debt load will start to go down, and it will go down regardless of whether any of his proposed savings are “fake” or “real.”