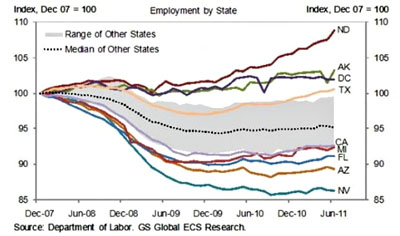

Hey, it’s Texas Miracle time again! The latest analysis comes from Goldman Sachs, which concludes that Texas is indeed a positive outlier when it comes to employment. In the chart on the right, where the gray blob represents the normal range of state employment, Texas is the gold line just above the normal range. That’s good news for Texas, but sadly, it’s where the good news stops for Rick Perry’s claim to economic superstardom. The report concludes that three factors are overwhelmingly responsible for good employment performance over the past three years:

Hey, it’s Texas Miracle time again! The latest analysis comes from Goldman Sachs, which concludes that Texas is indeed a positive outlier when it comes to employment. In the chart on the right, where the gray blob represents the normal range of state employment, Texas is the gold line just above the normal range. That’s good news for Texas, but sadly, it’s where the good news stops for Rick Perry’s claim to economic superstardom. The report concludes that three factors are overwhelmingly responsible for good employment performance over the past three years:

- Lack of a housing bubble. Texas really does have something to teach us on this score — namely that sensible government regulation of the mortgage market is a pretty good idea — but this is not exactly something Perry is eager to preach about. (And he wasn’t responsible for it anyway.)

- An oil industry. ‘Nuff said. Lucky is lucky.

- Lots of high-end services and technology. Actually, I suspect Texas has done fairly well on this score over the past decade, but it’s still not a leader of the pack. Texas-wise, housing and oil are the big story here.

And what wasn’t responsible for strong employment performance? Here’s the list:

- State income tax rates

- State property tax rates

- State spending as a share of the economy

Goldman analyst Zach Pandl’s conclusion:

For the national economy we see two main lessons. First, because housing and mortgage credit are central to the weakness around the country, these issues should probably continue to receive attention from policymakers. Second, because the outperformance of a few states is closely related to natural resource exposure it is not easily replicable elsewhere.

Roger that. Fix the housing mess and — well, that’s about it, unless we suddenly discover oil in Arizona and Florida. Since that’s not likely, how about if we just focus on the housing mess instead?