As I said earlier, I think S&P was wrong to downgrade U.S. debt. It was a panicky reaction to a bit of ugly, but ultimately mundane political squabbling that hasn’t really lasted very long in historical terms. If we’re still threatening serial defaults in 2015, then fine. Pull  the trigger. But nothing much has changed about our long-term entitlement problems lately, our demographic trends remain more favorable than in most countries, and progress on tough issues like Medicare and Social Security legitimately takes years, not months.

the trigger. But nothing much has changed about our long-term entitlement problems lately, our demographic trends remain more favorable than in most countries, and progress on tough issues like Medicare and Social Security legitimately takes years, not months.

That said, it’s true that our recent behavior has been unusually ugly, and S&P’s case for downgrade isn’t wholly without merit. What’s more, whether I think they were right or not, they certainly telegraphed their intentions well ahead of time. This is from their statement tonight:

The political brinksmanship of recent months highlights what we see as America’s governance and policymaking becoming less stable, less effective, and less predictable than what we previously believed. The statutory debt ceiling and the threat of default have become political bargaining chips in the debate over fiscal policy.

Translation: Argue over the budget all you want, but Republican games over the debt ceiling simply aren’t compatible with being a AAA superpower. Then, after some pro forma jabs at everyone for being unwilling to cut a better deal, they really lay into the GOP:

Compared with previous projections, our revised base case scenario now assumes that the 2001 and 2003 tax cuts, due to expire by the end of 2012, remain in place. We have changed our assumption on this because the majority of Republicans in Congress continue to resist any measure that would raise revenues, a position we believe Congress reinforced by passing the act.

Translation: America’s future fiscal stability will require higher taxes, and in the past we assumed that, political bluster aside, everyone knew that. But apparently not, and Republican intransigence on this point is endangering the country. Daniel Gross says this more pointedly:

It has long been obvious to all observers — to economists, to politicians, to anti-deficit groups, to the ratings agencies — that closing fiscal gaps will require tax increases, or the closure of big tax loopholes, or significant tax reform that will raise significantly larger sums of tax revenue than the system does now. Today, taxes as a percentage of GDP are at historic lows. Marginal rates on income and investments are at historic lows. Corporate tax receipts as a percentage of GDP are at historic lows. Perhaps taxes don’t need to rise this year or next, but they do need to go up in the future.

….This calamity was entirely man-made — even intentional. The contemporary Republican Party is fixated on taxes. It possesses an iron-clad belief that the existing tax rates should never go up, that loopholes shouldn’t be closed unless they’re offset by other tax reductions, that the fact that hedge fund managers pay lower tax rates than school teachers makes complete sense, that a reversion to the tax rates of the prosperous 1990’s or 1980’s would be unacceptable.

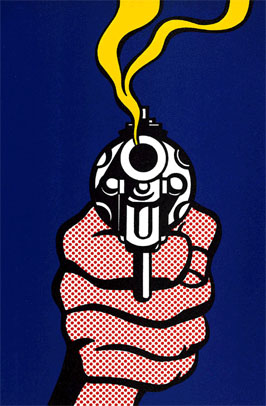

Again: regardless of whether S&P is right or wrong, everyone knew this was coming. All along, deals have been on the table that would have ended the threat of downgrade — deals that a Democratic president proposed even though they included program cuts that were agonizing to most of his fellow Democrats. But Republicans simply refused to consider them. In the end, they preferred to gamble with the financial decline of the country rather than face the obvious reality that eventually revenues are going to have to increase as America ages. It’s like watching someone mindlessly playing Russian roulette with five chambers loaded. One round has just gone off, and if nothing changes it won’t be the last.