Herbert Grubel says that Warren Buffett’s plan to raise taxes on the wealthy wouldn’t do much good:

Recently, he used his formidable reputation to suggest in the New York Times, Financial Post and an interview with Charlie Rose on PBS that the U.S. government should raise taxes on the 400 super-rich, who in 2008 together earned $90.9 billion and paid only on average 21.5 percent of it in taxes. That is lower than the average percentage paid by most middle-income Americans.

….[If taxes on the super-rich went up to 50%] revenues from the top 400 earners would go up by $26 billion….Since this year alone, the U.S. federal deficit will be around $1.4 trillion, or $3.8 billion a day, the new revenue would cover less than seven days of deficits. The numbers are even worse for total federal spending. In 2010, that amounted to $3.6 trillion or $9.7 billion a day. Buffett’s new taxes up against that would be gone in just 2.7 days.

But these numbers are excessively optimistic because the amount raised by higher taxes is likely to be much smaller than $26 billion discussed above. That is because, as he notes, a large proportion of the total income of the super-rich comes from capital gains and financial trading, which is at the discretion of taxpayers.

Grubel is right. Raising taxes on 400 people won’t do much good. But he seems unaware that this argument points directly to a simple solution: instead of raising taxes on 400 rich people, raise them on 4 million rich people. That  would cover a lot more than seven days of the deficit. And that top 4 million has done mighty well for itself over the past three decades.1

would cover a lot more than seven days of the deficit. And that top 4 million has done mighty well for itself over the past three decades.1

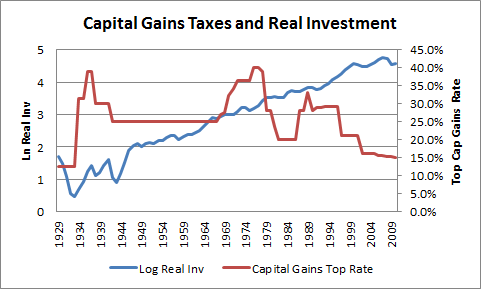

The rest of Grubel’s piece is a tired repetition of the usual talking points about how returning taxes to their Clinton-era levels would devastate the morale of entrepreneurs everywhere, all of whom are hoping to become the next Warren Buffett. These entrepreneurs, of course, did just fine in the 60s, when tax rates were considerably higher than they are today, and they did just fine in the 90s, when top rates were a crushing 4.6 percentage points higher than they are now. Buffett is right and Grubel is wrong: entrepreneurs can get discouraged, but not by the difference of a few points in their tax rates 20 years in the future. For most of these guys, a difference of five points in their tax rate is simply dwarfed by the key factor in their success: whether their company does well. That’s it. If your company does well you’ll be rich regardless of whether capital gains rates are 15% or 30%. If it doesn’t, you won’t. End of story.

It’s a different story for corporate CEOs, Wall Street traders, and the idle rich. For them, this stuff really matters. But entrepreneurs? They just want you to buy their stuff. Don’t believe the snake-oil salesmen who tell you otherwise.

1A reader reminds me that Buffett is well aware of his. His recent NYT op-ed, after calling for spending cuts, specifically endorsed higher taxes on a wide range of the wealthy:

But for those making more than $1 million — there were 236,883 such households in 2009 — I would raise rates immediately on taxable income in excess of $1 million, including, of course, dividends and capital gains. And for those who make $10 million or more — there were 8,274 in 2009 — I would suggest an additional increase in rate.

That’s not 4 million, but it’s a lot more than 400.