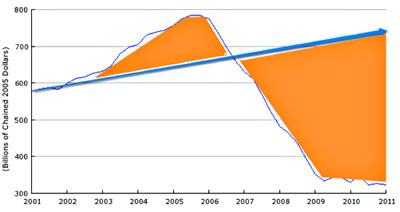

Here are two charts about housing. The first is from Brad DeLong, and it shows how much housing was overbuilt during the boom of the aughts. The blue line is trend growth, and the orange triangle that goes from 2002-07 amounts to about $300 billion dollars in excess housing. Since then, however, we’ve been massively underbuilding housing. That’s the orange block that starts in 2007, and it already amounts to $1.2 trillion. It will probably add up to $2 trillion or more by the time we get back to the trend line. That’s a net undersupply of $1.7 trillion.

Here are two charts about housing. The first is from Brad DeLong, and it shows how much housing was overbuilt during the boom of the aughts. The blue line is trend growth, and the orange triangle that goes from 2002-07 amounts to about $300 billion dollars in excess housing. Since then, however, we’ve been massively underbuilding housing. That’s the orange block that starts in 2007, and it already amounts to $1.2 trillion. It will probably add up to $2 trillion or more by the time we get back to the trend line. That’s a net undersupply of $1.7 trillion.

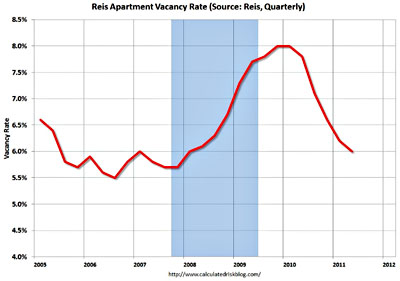

The second chart comes from Calculated Risk, and it shows the apartment vacancy rate. During the recession it rose to about 8% as people left their apartments and moved in with family or roommates. (This shows up in statistics as a slowdown in the rate of family formation.) However, as the worst of the recession recedes, that number is coming down, and today it’s nearly at its normal pre-bubble level of 5.5%. If the economy continues to recover, we’ll very soon hit a point at which there are lots of people who want to rent or buy a home but there will be a huge undersupply of both single-family and multi-family housing to absorb them. Karl Smith is unnerved:

The second chart comes from Calculated Risk, and it shows the apartment vacancy rate. During the recession it rose to about 8% as people left their apartments and moved in with family or roommates. (This shows up in statistics as a slowdown in the rate of family formation.) However, as the worst of the recession recedes, that number is coming down, and today it’s nearly at its normal pre-bubble level of 5.5%. If the economy continues to recover, we’ll very soon hit a point at which there are lots of people who want to rent or buy a home but there will be a huge undersupply of both single-family and multi-family housing to absorb them. Karl Smith is unnerved:

There is a huge demand bulge waiting in the wings. There is no supply coming on line on absorb it. Rental vacancies are already falling.

This is setting up to be the story of 2012 and it is setting up to be a doozy. Inflation creeping higher despite the Feds best efforts to tamp it down. A possible explosion in the growth rate if we get a virtuous cycle of more construction job leading to more household formation, leading to more construction jobs.

Maybe! As Brad points out, this all depends on unemployment falling enough to generate lots of new families that want — and can afford — a place of their own. So far, there’s not much sign of that happening, and American families continue to have a huge debt overhang that’s likely to keep demand sluggish. Still, if housing keeps getting tighter and employment starts to rise even modestly, we might indeed get the virtuous cycle that Karl talks about. We’ll see next year.