Today, the LA Times does its best to help out the Fed by increasing inflation expectations, splashing this across its front page:

Today, the LA Times does its best to help out the Fed by increasing inflation expectations, splashing this across its front page:

Rumblings of inflation grow louder

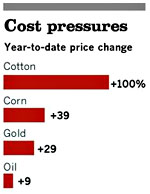

On Tuesday prices of many raw materials continued to surge, with gold, cotton and sugar reaching record highs. A closely watched index of 19 major commodities closed at a two-year high, despite a late-day sell-off in gold and oil. The effects are rippling from financial trading floors to local stores, forcing consumers to shell out more for everyday basics — a cup of coffee, a box of cereal, a gallon of gasoline.

….Take breakfast. This year alone, raw coffee prices on commodity exchanges are up 60%. Corn and soybeans, the basic feed for hogs and cattle, have risen 39% and 26%, respectively. Wheat, a dietary staple for many cultures, is up 33%, and sugar is up 23%.

Sounds grim. Of course, down in the 13th paragraph we get this from the Department of Agriculture’s Economic Research Service:

The agency forecasts that overall inflation for food prices, projected at 0.5% to 1.5% this year, in 2011 will range from 2% to 3%….Raw material costs often represent only a small portion of the final retail price of a product, compared with labor, marketing and transportation.

Huh. So food will be up maybe 1% this year and 2-3% next year. That’s pretty mild, and almost entirely a good thing. More inflation, please.