From Flickr user <a href="http://www.flickr.com/photos/muffytyrone/4096766913/">muffytyrone</a> used under a CC license.

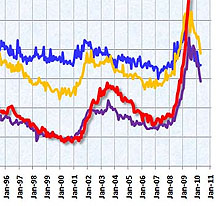

Just a quick additional note about long-term unemployment — i.e., those who have been unemployed more than six months. Normally, the long-term unemployment rate is considerably lower than the short-term rate, and tracks roughly equal with the rate of the medium-term unemployed (those out of work 15-26 weeks). The chart snippet on the right, with long-term unemployment in red, shows this. So if this recession had followed the usual pattern, long-term unemployment would have peaked a few months ago at about 2% of the labor force and would now be down in the neighborhood of 1.5% or so. Instead, it’s at nearly 4.5% and still climbing.

Here’s what this means: if this recession were following the usual pattern, total unemployment would have peaked several months ago not at 10%, but at around 7% or so. This is just a back-of-the-envelope figure after looking at the raw BLS numbers, but it’s in the right ballpark. And that’s a huge difference. Unemployment of 7% is bad, but it’s not catastrophic.

Here’s what this means: if this recession were following the usual pattern, total unemployment would have peaked several months ago not at 10%, but at around 7% or so. This is just a back-of-the-envelope figure after looking at the raw BLS numbers, but it’s in the right ballpark. And that’s a huge difference. Unemployment of 7% is bad, but it’s not catastrophic.

I don’t yet have anything deep to say about this. I’m still just noodling over the data. But as this makes clear, the depth of our current recession is almost entirely due to the fantastically high and unprecedented amount of long-term unemployment. I don’t know if that’s cause or effect or something in between, but it’s important.