Email from a friend involved in the legal end of the commercial real estate market:

Email from a friend involved in the legal end of the commercial real estate market:

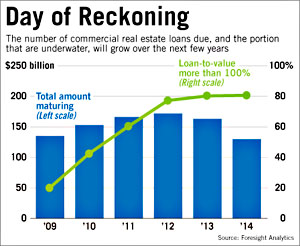

We just had yet another lender pull the plug on a commercial real estate deal that was set to go. The stated reason was minor and technical. The real reason we’re guessing is that it has too many underwater loans on its books and simply doesn’t have the resources.

So what is happening now? Remember the doom and gloom scenario of mass foreclosures by banks to get the bad commercial real estate loans off their books? Well, if my purely anecdotal experience with the first few months of 2010 are any indication, that scenario will not be happening any time soon — which is a bad thing. It will not be a dramatic cascade but a slow tentative process with limited positive impact on the economy.

Instead, it appears that banks are continuing to grant very long deferments rather than take the loans down. The logic here is bizarre, but understandable I guess. They are punting on the issue until the economy improves, which they are betting is next year or so. But if they don’t get the bad loans off their books, they can’t free up their resources to provide the necessary new financing to recharge the economy. Then next year they’ll punt again. And the vicious circle continues. I’m not sure what the government can do here, but I sure hope there is some creative thinking going on in D.C.

It’s just a single data point, but I’ll bet there’s a lot of similar stories out there. We may have saved the banking system last year, but it’s still in pretty fragile shape.