<a href="http://commons.wikimedia.org/wiki/File:PaulRyan.jpg">Wikimedia Commons</a>

Rep. Paul Ryan’s tax and spending “roadmap” is a fascinating critter: conservatives all praise it to the skies but none of them want to actually commit to supporting it. The reason for their hesitation is obvious: Ryan’s plan would cut spending dramatically, and supporting it would mean having to explain what, exactly, they’d cut. That would be electoral suicide and they know it. They much prefer their usual game of loudly denouncing “spending” without ever having to say what spending they’re actually opposed to.

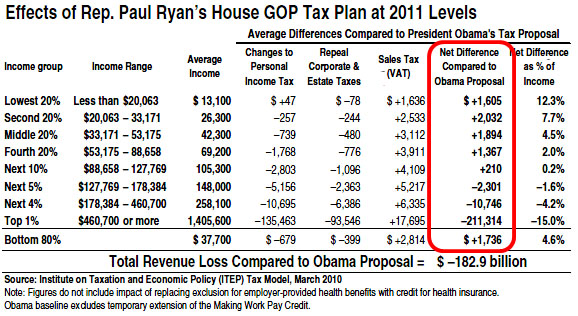

However, their reason for supporting Ryan’s plan is also obvious: it would cut taxes on the rich dramatically, and there’s nothing conservatives like better than cutting the tax bills of America’s wealthy. But how much would it cut taxes on the rich? Citizens for Tax Justice has run the numbers and the answer is: a lot. The very richest of the rich would see their tax bills go down by an average of over $200,000, a whopping 15% of their income. Ka-ching! To make up for that, everyone with an income under $100,000 would have their taxes increased by about $2,000 per year.

It’s a sweet deal for the rich. But even with all the tax increases on the middle class, Ryan’s plan still raises less revenue than today’s tax code. “It’s difficult to design a tax plan that will lose $2 trillion over a decade even while requiring 90 percent of taxpayers to pay more,” says CTJ acerbically. “But Congressman Ryan has met that daunting challenge.” Details are in the table below, where you can find out how much more you’d have to pay under Ryan’s plan. Enjoy.