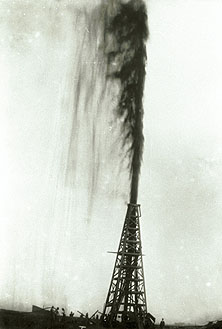

Housing wasn’t the only financially induced asset bubble in the aughts:

Housing wasn’t the only financially induced asset bubble in the aughts:

In a move aimed at limiting financial speculators’ ability to drive up oil prices, the Commodity Futures Trading Commission on Thursday proposed restrictions on the number of energy contracts that any single investor can hold and new limits on the trading activities of Wall Street banks.

….The Commodity Futures Trading Commission seeks to establish a limit on how many contracts an investor could have across all regulated markets in which oil and natural gas are traded. This would broaden the limits that existed before 2001, since it would apply not only to contracts for future delivery of oil, but also to markets that involve the physical delivery of oil and natural gas.

That’s important, because several Wall Street firms got involved not only in the speculative futures market but also in the physical markets, giving them tremendous potential for market manipulation. Morgan Stanley, as a player in the physical market, controls an estimated 15 percent of the home-heating oil supply in New England. Goldman Sachs owns shares of companies that own pipelines and refineries.

The case for a speculative bubble in oil is still, if you’ll pardon the expression, a little more speculative than the airtight case for a housing bubble, but there’s no question that the evidence seems to point more in that direction that it did a couple of years ago. Which is no big surprise, I suppose: after all, what we really had was a credit bubble, not just a housing bubble. And when there’s lots of credit sloshing around, it’s bound to drive up a lot of asset prices.

In any case, the position limits the CFTC is proposing are relatively modest. It’s worth giving them a try.