THERE ARE NO SUPERMARKETS within a day’s drive of Igiugig, Alaska. In fact, there are no roads anywhere near Igiugig (pronounced Iggy-OGG-ig), except for the dirt track that runs between its dozen tin-roofed cabins and the airstrip. Sitting on the south shore of Iliamna Lake, at the mouth of the Kvichak (KWEE-jack) River, the village is accessible only by light plane, small boat, ATV, or snow machine. If you want to go grocery shopping, you have three choices. You can patronize the tiny village store, which offers a sparse selection of canned goods, frozen meats, and household supplies. You can order a shipment from Costco or Sam’s Club and have it flown in from Anchorage, 240 miles to the northeast.

Or you can do what Michael Andrew is doing on this October morning, as the tundra sops up a light rain. Dressed in a black slicker and a baseball cap, the moonfaced septuagenarian scrambles down the riverbank to his skiff, moored in a tangle of gold and russet brush. He carries a rod and tackle box; a hunting rifle is slung over his shoulder by a fraying strap. “Gonna go catch me some dinner,” he calls to a neighbor. “Maybe get me one salmon and one whitefish.”

Andrew is an Aleut elder; his people have lived off the land and water hereabouts for 9,000 years. His neighbor is a very different breed of fisherman: Brian Kraft, the 39-year-old owner of the Alaska Sportsman’s Lodge, which lies a mile downstream. “Still a few spawned-out sockeye in there,” Kraft affirms before nosing his own battered outboard into the current. With his bullterrier build, rough-hewn features, and muddy waders, Kraft could pass for a bush-country local. In reality, he grew up in Chicago, is a former professional hockey player, and has a degree in marketing. Guests at his cedar-framed hostelry pay $6,950 a week (guide service, floatplane transport, and filet mignon included) to troll the Kvichak—known to anglers as the most abundant salmon stream on the planet and as home to some of Alaska’s most gargantuan rainbow trout.

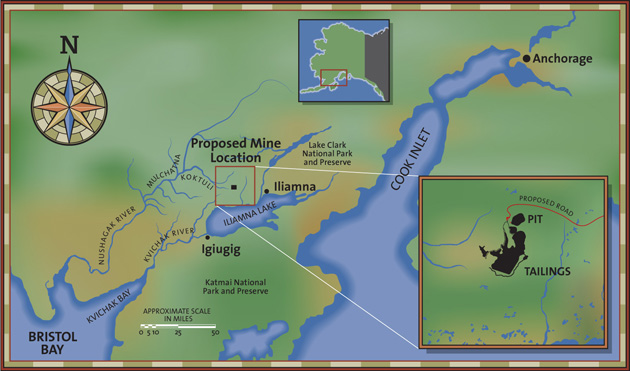

Yet Kraft’s attachment to this stretch of clear, swift water goes deeper than the bottom line. “This river is a powerful living thing,” he tells me, a note of awe softening his usually blunt delivery. “It’s alive, and it’s carrying life. It’s in my blood.” It is also, he says, under mortal threat. At the north end of Iliamna Lake, a company called Northern Dynasty Mines aims to unearth what may be the largest gold deposit—and the second-largest copper deposit—in North America. The proposed Pebble Mine complex would cover some 14 square miles. It would require the construction of a deepwater shipping port in Cook Inlet, 95 miles to the east, and an industrial road—skirting Lake Clark National Park and Preserve and traversing countless salmon-spawning streams—to reach the new harbor. At the site’s heart would be an open pit measuring two miles long, a mile and a half wide, and 1,700 feet deep. Over its 30- to 40-year lifetime, the Pebble pit is projected to produce more than 42.1 million ounces of gold, 24.7 billion pounds of copper, 1.3 billion pounds of molybdenum—and 3 billion tons of waste.

Northern Dynasty insists that the impact to the environment will be minimal, but there’s good reason to question such optimism. The EPA identifies hard-rock mining as the leading source of toxic releases in the United States, and open-pit mines are the worst offenders. In recent decades, these huge gashes in the earth—which allow for the exploitation of large low-grade ore deposits such as those found along Iliamna Lake—have replaced underground excavations as the most common type of mine. Giant machines scoop out a man-made canyon; mineral-rich rock is separated from the worthless stuff, crushed in an on-site mill, and treated with chemicals to strip away the valuable material—for gold and copper, less than 1 percent of what is mined. Unused rock is stored in enormous piles, while the mill waste, a thick slurry known as tailings, is sequestered in an artificial pond. (The Pebble Mine’s tailings pond would likely measure some 10 square miles.) In theory, the pond—along with pumps and diversion channels, and perhaps a layer of soil tamped over the waste rock—keeps any harmful substances from leaching into the environment. In practice, mining waste can react with air and precipitation to create sulfuric acid runoff. It can contaminate streams and groundwater with heavy metals such as mercury, arsenic, and selenium. The chemicals used in processing the rock, including cyanide, can escape through accidents or leaks.

“I know the folks who build the Pebble Mine are going to try to do a good job,” says David Chambers, a Montana mining engineer and geophysicist who runs the nonprofit Center for Science in Public Participation (CSP2). “What I can say is that there will be problems. I’ve never seen a mine that doesn’t have them.” If Pebble’s poisons were to leach into nearby rivers, it could be devastating not only to the fish but to all the creatures that rely on them—from grizzly bears and bald eagles on up to native hunter-gatherers and lodge owners.

The damage could spread far beyond Igiugig. Bristol Bay is home to the world’s largest commercial wild salmon fishery; many of those fish spawn in the Kvichak and other tributaries in the Iliamna Lake area. This $93 million industry employs some 12,500 people and markets its product around the globe. “About 8 or 9 million salmon go up to the lake every year to spawn,” says Nick Kouris, a Greek-born gillnetter who has worked the bay since 1963. “If there’s a spill, it’s going to be a disaster.”

For Northern Dynasty, Pebble could prove to be a bonanza. Metal prices have climbed sharply over the past two years, driven largely by the economic booms of India and China, which have heightened demand for jewelry as well as industrial metals (copper is a key ingredient in electronic components; molybdenum, in steel alloys). Thanks to rising oil prices, gold, a traditional hedge in times of inflationary fears, has soared past $500 an ounce. The Pebble deposit’s potential worth is in the tens of billions. And this trove is just part of what may be a vast agglomeration of minerals coughed up by a massive volcano millions of years ago. Recent discoveries of higher-grade ore could lead Northern Dynasty to build an underground mine just east of the pit; early estimates suggest that its value could rival that of its neighbor. Other mining companies have staked claims totaling roughly 1,000 square miles around Northern Dynasty’s turf, and the federal Bureau of Land Management reportedly aims to open 3.6 million acres beyond that to mineral exploitation.

Map by Kopp Illustration

Most claims never become actual mines. But if even a fraction of them do, Lieutenant Governor Loren Leman told an audience in 2004, “this could be Alaska’s second gold rush.” Advocates and foes of Pebble see it as a test case. If it proceeds, the Bristol Bay watershed could be transformed from a sparsely settled wilderness into a busy mining district, its pristine landscape gouged beyond recognition.

Brian Kraft has made it his mission to prevent that from happening. “This is just too risky an operation in too sensitive an area,” he says. “Somebody needs to step up and say, ‘It just ain’t worth it.'”

EVER SINCE THE KLONDIKE GOLD RUSH of the late 1890s, Alaska’s fortunes have been tied to the vicissitudes of a resource-extraction economy. Successive bouts of gold fever brought waves of settlers and flushes of prosperity, the last of which petered out by the 1920s. Then, in 1957, oil was discovered on the Kenai Peninsula, providing the impetus for statehood two years later and the capital to fund it. Another flood of riches came in 1968, with the discovery of North America’s largest oil field at Prudhoe Bay. Workers poured in from around the world to grab high-paying jobs building the Trans-Alaska Pipeline. Royalties from North Slope oil eventually allowed Alaska to abolish state income taxes—instead, every resident receives a yearly dividend of almost $1,000.

There is a dark side, of course, one exemplified by the Exxon Valdez disaster and the warming trend—fueled in part by Alaska’s own hydrocarbons—melting the permafrost beneath many Arctic villages and the pipeline itself. And busts have invariably followed the booms. In 1985, petroleum prices collapsed, triggering bank defaults and mortgage foreclosures. Although the economy recovered, the good times never fully returned. North Slope production has been declining since the early ’90s. In response, the state’s politicians have touted more extraction, including drilling for oil in the Arctic National Wildlife Refuge (ANWR), and building a natural gas pipeline from the North Slope to the Lower 48.

Mineral extraction is a less reliable cash cow than petroleum production (the royalties mining companies pay Alaska are less than 3 percent of the value of their net revenues, versus up to 25 percent for oil companies), but it’ll do in a pinch. And so, as it has in much of the West, mining has been staging a quiet comeback in Alaska. There are three large hard-rock mines operating in the state, and eight more are in the planning stages. None, however, is as big as the proposed Pebble Mine—or, opponents say, in a position to do as much environmental harm.

On a floatplane ride over the area, Kraft provides me with a bird’s-eye view of what’s at stake. The plain below us is a patchwork of sedges, lichens, and dwarf spruce; shades of peat brown, moss green, and mustard yellow glow like a fine bolt of Harris Tweed beneath the slate-colored sky. Tundra swans skim the edges of rocky hillocks, touching down on ponds as clear as cellophane. No trace of human presence is visible until we pass over the Pebble site, with its weather-recording station and handful of drilling shacks.

The Pebble complex would sit 15 miles north of Iliamna Lake—Alaska’s largest body of fresh water, 80 miles long by 20 miles wide—and at the headwaters of two rivers. The Upper Talarik flows into the great lake, which drains into the Kvichak, which in turn empties into Bristol Bay. The Koktuli River rises from a glacial scour known as Frying Pan Lake, which would become part of the mine’s tailings impoundment; it flows into the Mulchatna, which joins the Nushagak, which pours into the bay west of the Kvichak. “All these rivers are world-class trout and salmon streams,” Kraft shouts over the engine’s drone. The land in between is veined with brooks and rivulets, riddled with pools and puddles. It looks as permeable as a sponge.

The Canadian mining company Teck Cominco first staked the Pebble claim in 1988—the same year Kraft arrived at the University of Alaska Anchorage on a hockey scholarship. Gold prices soon sagged, however, and the site lay dormant for more than a decade. Kraft went on to play for an Italian team and the minor league Anchorage Aces. When he opened his lodge in 1997, after building it by hand with a few teammates, he had no idea of what lay in the hills beyond the lake. Kraft retired from hockey in 2000. In 2001, as gold rebounded, another Canadian company—Northern Dynasty Minerals—bought out Teck Cominco’s mining rights. It formed an Anchorage-based subsidiary, Northern Dynasty Mines, which began quietly assessing the site’s potential. Three years later, convinced it had a whopper, the company upgraded Pebble from an “exploration” to a “development” project and notified the state that it planned to apply for mining permits. Helicopters began buzzing over the site, work crews set up rigs to drill core samples, scientists started taking environmental measurements, and residents of the villages around Iliamna Lake began to take notice.

In May 2004, Dan Salmon, Igiugig’s village administrator, asked Kraft what he thought about a mine in the neighborhood. Kraft offered to do some sleuthing. “At first,” Kraft says, “I thought, ‘Hey, it’s gonna be a good thing for the area.’ I’m a businessman, so the thing that came to my mind was economic prosperity for the people here.”

The more he looked into the potential side effects, however, the more alarmed he became. He invited a mining geologist to consult; she brought a long list of open-pit metal mines—several built in the past 20 years and touted as state-of-the-art—that had befouled their surroundings: the Gilt Edge Mine in South Dakota, Zortman Landusky in Montana, Grouse Creek in Idaho, Rain in Nevada, Summitville in Colorado, Greens Creek and Red Dog in Alaska. Kraft learned about fish kills, acidified streams, and land blanketed with toxic dust. Some mine owners had gone bankrupt, leaving festering scars that would have to be decontaminated in perpetuity; because the reclamation bonds (a security deposit paid to the state) had been inadequate, taxpayers were forced to foot the bill. And Alaska’s reclamation rules are far laxer than those of most states, allowing companies to substitute a “corporate guarantee”—a promise—for a portion of actual bonds.

One of Kraft’s lodge guests, a mining executive from Nevada, told him: “I certainly wouldn’t want this kind of mine here if I had a business that depended on clean water.” But the fervently pro-development administration of Governor Frank Murkowski exhibited no such qualms. Alaska’s Department of Natural Resources even signed a memorandum of understanding with Northern Dynasty, agreeing to help ensure “the timely and efficient completion” of the permitting process (see “Minions of Midas,” page 50). There is little doubt that the state, left to its own devices, would sign off on the mine: Alaskan officials have almost never turned one down.

Kraft did not consider himself the tree-hugger type. A jock who liked to hunt and fish, he’d worked one summer as an oil roughneck on the North Slope. He had his hands full with his business and raising his daughter, Amber, then three. (Kraft and his ex-wife share custody.) But he was damned if he was going to let anyone wreck his river—or his neighbors’ way of life. He’d been in a floatplane crash near Igiugig during the lodge’s first season; he’d spent three days in a coma, and the locals rallied around him. “One of the ladies, an elder, knitted me a pair of get-well mittens,” he says. “I feel a very close attachment to that village.”

As a 5-foot-8 wingman, Kraft was known for a fierceness that allowed him to overwhelm larger opponents. By November 2004, he’d mustered that intensity to form the Bristol Bay Alliance to fight the Pebble project. He enlisted two experts—David Chambers, from CSP2, and Scott Brennan, campaign director of the Anchorage-based Alaskans for Responsible Mining—and set out on a lecture tour. “We got in an airplane in the middle of winter,” he recalls, “and we flew to Ekwok, to Koliganek, to Stuyahok, to Iliamna, to Nondalton, to Pedro Bay. We put on a PowerPoint presentation that said, ‘Here’s what mines look like, here’s what they’ve done in the past.'” Later, Brennan arranged for 17 local leaders to tour Nevada’s most polluting mines.

Before long, seven villages had passed resolutions against Pebble; so did the Alaskan Inter-Tribal Council, the Alaska Independent Fishermen’s Marketing Association, the Alaska Wilderness Recreation and Tourism Association, and various state environmental organizations. Trout Unlimited, a national conservation group with 150,000 members, embraced the Alliance and hired Kraft to be its local coordinator. Anchorage financier Bob Gillam, an avid sport fisherman and lodge owner, reportedly donated $2 million to the cause. Two former Alaska governors, Walter Hickel and Jay Hammond (now deceased)—both Republicans—publicly questioned the project. “In my view,” Hammond told the New York Times, “it’s one of the least appropriate spots for a mine.” The area, he said, was even more sensitive than ANWR. Recently, even Senator Ted Stevens (R-Alaska)—a champion of drilling in ANWR but a friend and ally of Gillam’s—joined the anti-Pebble chorus. “It is critical,” he told Petroleum News in February, “that an environmentally sound plan is found before any exploration and development is authorized to proceed.”

But Northern Dynasty has been waging a PR offensive of its own. Its representatives travel the bush-plane circuit, holding public meetings and tête-à-têtes with village councils. They host tours of the Pebble field camp in Iliamna and arrange excursions to the Fort Knox mine, near Fairbanks. They repeat a soothing litany: Most modern mines are clean and well run. Pebble would use the latest antipollution technology. The mine’s design would make it as environmentally friendly as possible. “We’re collecting data on surface water hydrology, fish resources, wildlife, wetlands,” says Ella Ede, Northern Dynasty’s environmental project manager. “The company’s philosophy is that a mine can be developed responsibly. Yes, there will be impacts, but those can be minimized and managed.”

IT’S HARD TO SAY WHICH SIDE is winning this bush-hopping battle for hearts and minds. And to understand why, it helps to talk with Dan Salmon—the local administrator who first set Kraft on his quest. Salmon, 47, juggles several small business ventures along with his civic duties. Tall and rawboned, with a bristling mustache, he runs this empire from an office in the Igiugig village council building, a large shed that also serves as the hangar for the airstrip. Ask him about the mine, though, and he loses his decisive air. “I’m riding the fence,” he says, noting that Igiugig is not among the villages that have taken a position on Pebble. Six out of the settlement’s ten households had a member employed by a mining company in 2005. Some did semiskilled work for exploration crews; others performed domestic chores at company-leased lodges and inns. “There’s a fair section of the community that’s looking at this as a viable career,” says Salmon. “I don’t think it’s fair of me to extinguish their hopes.”

The Iliamna Lake region is one where hope is in relatively short supply. It sits at the northeast corner of the Lake and Peninsula Borough, a vast county whose southwestern portion fronts Bristol Bay. The borough’s population of 1,600 is three-quarters Native Alaskan (mainly Aleut, Athabascan, and Yupik Eskimo), and its income per capita of $21,783 is 30 percent below the national norm. The villages around the lake are even poorer; in Igiugig, for example, income per capita is $13,172. And work is getting harder to find.

Salmon, an émigré from Rochester, New York, is today an assemblyman for the borough. He started visiting the area in 1981, as a summer employee of the state Fish and Game department; soon afterward, he married a local woman and settled in Igiugig. In those days, seven households had commercial fishing permits for Bristol Bay. Each spring, he says, “the whole lake region moved out en masse to that fishery.” But disaster struck in 1996, when Congress passed the Magnuson-Stevens fishery management act.

Generally speaking, Magnuson-Stevens did more good than harm. It introduced sweeping measures to protect marine habitat and prevent overfishing along America’s coasts. One of its subsections, moreover, was aimed specifically at boosting the economic prospects of Alaskan fishing villages. The law codified community development quotas (CDQs), instituted by federal regulators a few years earlier, which reserved a portion of the Bering Sea harvest for several dozen impoverished settlements. These communities, organized into six regional cooperatives, could catch and sell the fish themselves, or they could lease out their rights and invest the proceeds. Eventually, CDQ administrators set up programs to fund equipment purchases, municipal projects, college scholarships, even tax relief in years when the catch was lean. The downside: Only communities within 50 miles of the sea were eligible. Those in the interior not only lost out on benefits, they were effectively prohibited from catching certain fish, such as halibut. Unable to compete, fishermen in the lake region began selling their permits; today Salmon’s eldest son is the only person in Igiugig who still owns one. “With a stroke of the pen,” Salmon says, “they took our economy away.” Life in the villages became increasingly grim, and young people began leaving. The settlement of Ivanof Bay has become a ghost town; several villages are in danger of losing their schools for lack of students.

Not that the CDQ-eligible villages have had it easy, either. In the mid-’90s, wild salmon populations crashed, and competition from farmed salmon sent prices plummeting, from a high of $1.22 a pound to a low of 42 cents. Prices have rebounded somewhat, and the harvest has returned to normal. But soaring energy costs—gas can run as high as $6.60 a gallon in the bush, and heating oil as high as $3.90—have cut into the recovery.

Northern Dynasty estimates that the Pebble Mine would require 2,000 workers during the construction phase and 1,000 thereafter. Skilled jobs would pay up to $60,000 a year. Doubters contend that the borough’s 1,600 residents—43 percent of whom are under 18 or over 65—can’t possibly fill those jobs, and that the outsiders who will come to work on the project will tax the land and degrade native culture. Still, five villages and the borough assembly have passed resolutions in favor of the mine, hoping that it will attract more development and more jobs.

Michael Andrew Jr., 39, the son of Kraft’s subsistence-fishing neighbor, took a temporary job last summer cutting brush for Liberty Star, whose Big Chunk mining claim abuts Northern Dynasty’s. In his father’s day, when people got around on dogsleds, it was easier to do without cash, he says. “Now, you need a boat and a motor. You need an ATV. You need a snow machine. All that takes money. For me to stay here, I need an opportunity to work.” Andrew welcomes mining, whatever the environmental risks. “We don’t have an alternative out here. I got four kids. What are they gonna have in the future?”

ONE VERSION OF THE FUTURE can be found in Iliamna, the Pebble project’s lakeshore base of operations. Most of the region’s villages are sleepy places where the loudest sound is the wind off the tundra. By comparison, Iliamna (pop. 104) is a metropolis. Northern Dynasty has rented several buildings by the airstrip, and pickup trucks roar in and out of their parking lots. A helicopter clatters over an equipment yard, ferrying in pieces of drilling apparatus. Hard-hatted workers scurry about, clutching clipboards.

In a huge loaf-shaped white tent known as the core shack, geologist Jason McLaughlin is cataloging samples drilled from Pebble’s depths. The shack is lined with plywood shelves and worktables holding hundreds of shallow cartons. Each contains one 10-foot core sample, cut into five pieces, and is marked with the coordinates of its provenance. McLaughlin, an affable 35-year-old from Vancouver, British Columbia, spends his days estimating the mineral content of each sample and using the information to create maps of the site’s geology. “This is good stuff,” he says, examining a gray-white tube flecked with a faint glitter. “Those little specks are chalcopyrite. They’re about 35 percent copper.”

When McLaughlin finishes with a sample, it’s hauled outside to be sawed in half lengthwise; one of the halves is then shipped off to be assayed at an independent laboratory in Vancouver. The saw shack is manned by a local hire: Mike Borleske, 50, known to all as Fish Camp Mike. With his double-wide shoulders and lumberjack beard, Borleske cuts a Bunyanesque figure. A Wisconsin native with a degree in soil science, he moved to the region 13 years ago, aiming to open a lodge. He married an Athabascan woman and built his inn on the site of her ancestral fish camp, but when the salmon run faltered, the business tanked. He was broke and contemplating moving his family to the Lower 48 when the sawyer’s job at Pebble opened up.

Borleske is grateful to have found an economic lifeboat, but he is realistic. “This job’s not gonna last,” he acknowledges. “The exploration phase will be done next year, and the next phase will be construction. I don’t know if I’ll fit into that.” He smiles wryly. “I don’t know how much mining I’m actually going to get into.”

BRUCE JENKINS ADMITS to no such uncertainties. The chief operating officer of Northern Dynasty has an unusual background for a mining boss: He earned an M.S. in fisheries ecology. “I’ve been in the business for 30 years,” says Jenkins, 55, on the phone from Anchorage, “and have concentrated on ensuring that projects get designed and built in a manner that is sensitive to environmental values.”

Jenkins has a ready rebuttal, in briskly technical lingo, to almost every concern the Pebble critics raise. There’s no need to fret about acid runoff, he says. “Ninety-five percent of the material removed from the pit will be nonreactive material. But we designed a mill process that would separate the reactive streams, and they will be disposed of in the tailings impoundment, surrounded by rock that is acid-consuming and submerged in subaqueous storage.”

Cyanide? Not a problem. If Pebble uses the reagent—which it may not—to extract gold from low-grade ore, it will do so in a strictly controlled manner. Unlike heap-leach mines, in which cyanide is dribbled through open-air piles of ore, Pebble would use the chemical in a closed, in-mill circuit. “The cyanide is then removed and destroyed,” he explains, “before the tailings are shipped off to the tailings pond.”

The mine’s size and location? Barely relevant. Few salmon spawn so far up the Koktuli River, he says, and the Upper Talarik will be protected by geology and distance. “The footprint of our mine and our waste storage facility represents less than 0.06 percent of the entire watershed that supports the Bristol Bay fishery. Think about that number!” And in the unlikely event that the mine does disrupt fish populations, the company’s “no net loss” policy mandates enhancing them by other means. “You look at what the limiting factors are in a stream. You can remove gradient or velocity barriers. Maybe you add a little extra flow in the winter to offset freezing and damage to eggs that were deposited in the fall.”

Some experts remain unconvinced. Jim Kuipers, a veteran mining engineer who consults for public interest groups, notes that the Pebble copper deposit is of a chemical type known as porphyry, “and you cannot point to a porphyry copper in the proximity of water resources that hasn’t caused problems. There are things that can be done to mitigate it, but in many cases the mitigations aren’t adequate.”

David Chambers elaborates: “Mining companies will tell you, ‘Bad things happened in the old days. We know how to do it now.’ But I’ve got enough gray hair to tell you that’s the same thing they said in the old days, too.” Even at the best-planned mines, he says, tailings ponds leak. Cyanide tanker trucks skid off icy roads. And exploration companies like Northern Dynasty enter partnerships with (or sell out to) “majors”—multinational corporations, such as Newmont, Barrick, or AngloGold Ashanti, that have the experience and capital to operate a mine over the long haul.

Northern Dynasty is currently seeking a major to run Pebble. The people who call the shots, Chambers observes, “won’t be the ones who made the promises. And they’re going to be under a lot of pressure to operate in a profitable manner. Like the bumper sticker says, ‘Shit happens. ‘”

FOR MANY PEOPLE in the Bristol Bay region, taking a gamble on the Pebble Mine is preferable to accepting the bleak economic certainties of the status quo. But others are not willing to risk their birthright. The village of Nondalton, which is as close to the proposed mine as Iliamna—and stands to gain as much—was among those that voted against the plan. “Economically, it would benefit us for 30 to 50 years,” says Jack Hobson, a 47-year-old Athabascan who is president of the Nondalton Tribal Council. “But what is the generation supposed to do after the mine is gone? We could use some kind of employment source, but mining is not the source we’re looking at.”

Some Igiugig residents agree. “It kinda makes me angry a bit,” says Georgie Wilson. A silver-bearded trapper who lives in a ramshackle house full of seal and wolf pelts, Wilson, 69, credits his unwrinkled skin to a lifelong diet of wild fish and game. “There’s some good in the mine, but not enough to ruin the land.” At the local clinic, health aide Cecilia Suskuk, 32, wears an Air Force sweatshirt, picked up during a stretch in the service that took her as far as Wichita Falls, Texas. She returned to the Bristol Bay area because it was a wholesome place to raise her 11-year-old son. “He loves to fish,” she says, “and I want him to be able to continue to enjoy it.” She also worries that the mine might disrupt the migration patterns of moose and caribou—animals her family subsists on through the long winters.

Northern Dynasty expects to file for federal permits next year, at which point a public comment period will begin. Brian Kraft suspects that regulators may not be inclined to listen. So he and his allies are seeking ways to pressure the company—whose stock price could be battered by bad PR—into dropping the project. Given the breadth and vigor of resistance, an analyst wrote last year in the Resource Investor, “the risk to the project’s development…should not be underestimated.”

Yet the question remains: If Pebble falls through, how will people make a living? Lydia Olympic, 41, a program coordinator for Igiugig’s village council, envisions convening an “economic summit” so local leaders can brainstorm about alternatives. “We need to say, ‘Okay, what other options do we have?’ A lot of people in Igiugig say it sure would be nice in summer to have a little coffee stand with someone selling lattes. That’s a small step, but it’s a step.”

Kraft has bigger ideas. Sport fishing in the Bristol Bay area brings an estimated $77 million a year to the state, he notes, but the money winds up mostly in the pockets of lodge owners, outfitters, and other entrepreneurs. To spread the wealth, Kraft hopes to enlist the Bristol Bay Native Corporation—an entity established by the 1971 Alaska Native Claims Settlement Act, which invests in businesses across the United States and pays a modest dividend to members of the local tribes. “Why doesn’t the BBNC own a fishing lodge?” he asks. “They should own five lodges. You’d teach kids how to be guides, chefs, marketing personnel, accountants, pilots. You could have a huge job base.”

Gold mines can go bust, but salmon are a renewable resource that enriches everyone, notes Kraft. “They feed not only the United States—they feed the world,” he says. “Everybody has a stake here.”