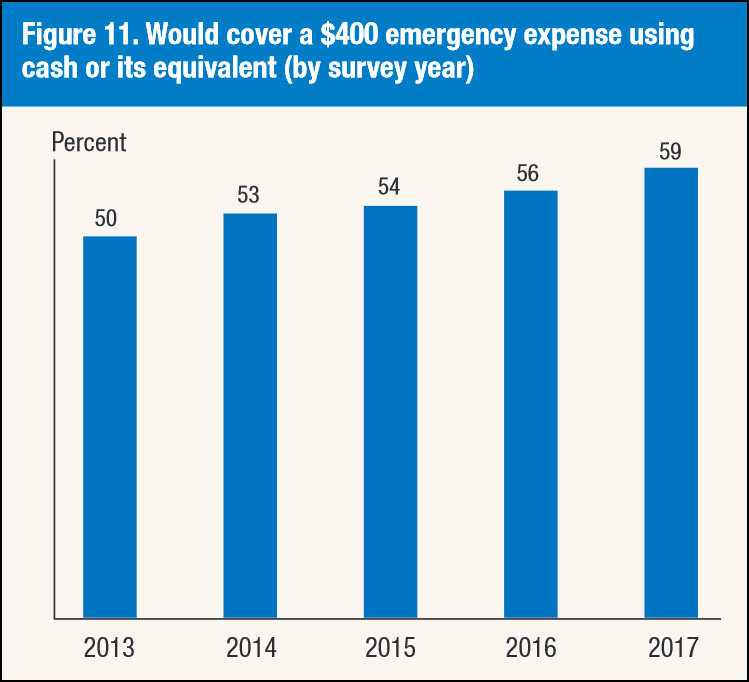

Every year we learn that lots of people don’t have enough savings to cover a $400 emergency expense. Here’s the Post yesterday:

Four in 10 adults still say they don’t have enough savings to cover a $400 emergency expense, according to the latest Federal Reserve report on the economic well-being of Americans. While that is an improvement over 2013, when half of Americans said they could not cover a $400 expense, it remains elevated at a time when unemployment is so low and wages are rising.

This is a reminder, says Heather Long, “that the U.S. economy has deep structural problems that are far from being cured.”

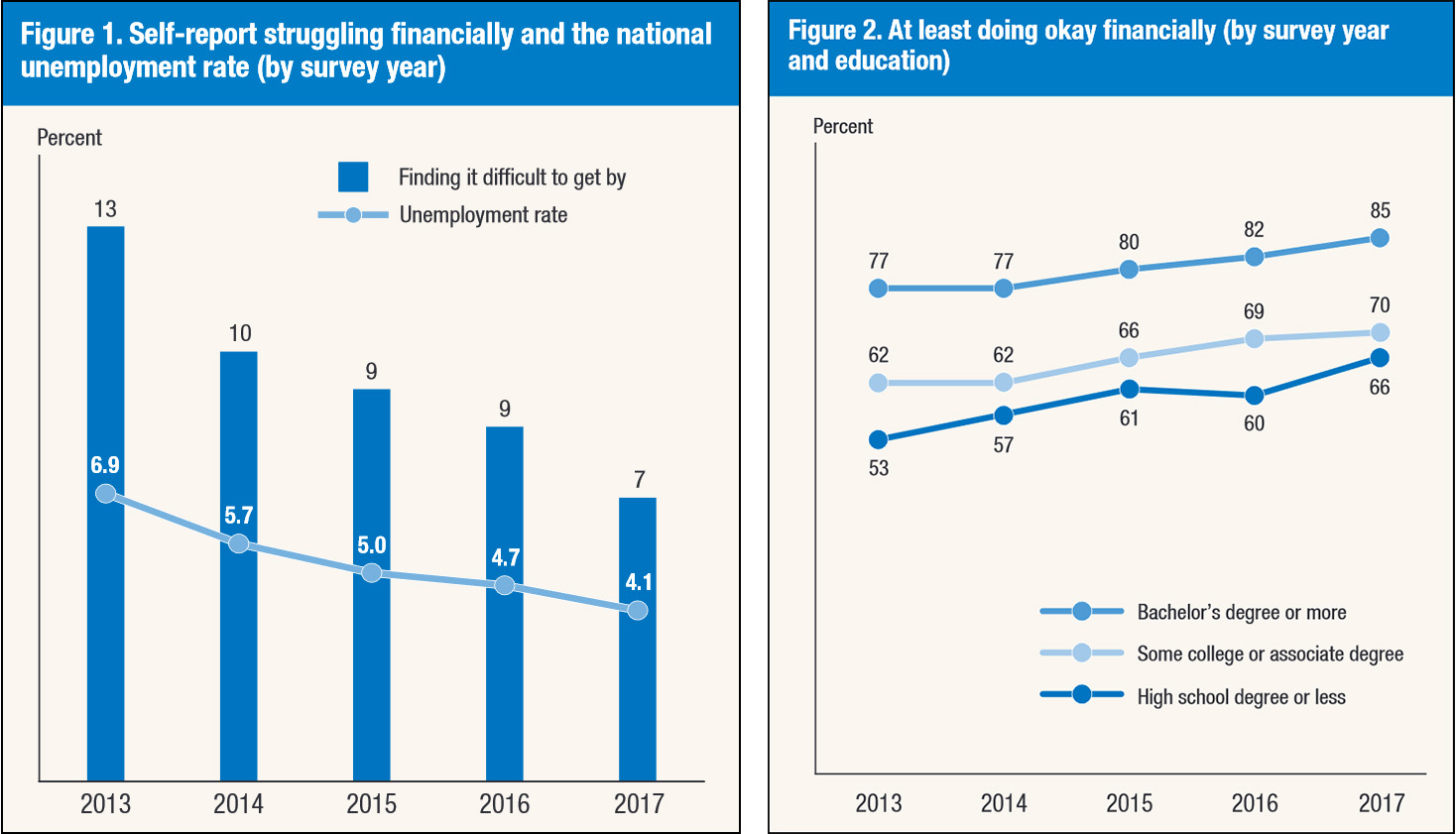

I suppose so. But I finally got curious about where this statistic comes from every year like clockwork, and the answer turns out to be the Federal Reserve’s “Report on the Economic Well-Being of U.S. Households.” It’s based on their annual Survey of Household Economics and Decisionmaking (SHED), which they’ve been conducting since 2013. Here are a couple of charts from the 2017 report:

Both of these charts suggest that although we’re not yet in financial nirvana, pretty much everyone has been doing steadily better over the past five years. And only 7 percent of the population reports that they’re finding it “difficult to get by.” Now here’s the $400 emergency expense chart:

That’s going steadily up too. It’s certainly true, as Fed chair Jerome Powell says, that aggregate statistics “tend to mask important disparities by income, race and geography,” but it’s also true that things are getting better for just about everyone.

They aren’t getting better very fast, though, and there’s probably a recession due in the next year or two. That’s when we’ll find out just how resilient our economy really is and how well our lowest-income workers are doing.