A new Pew report shows that our investment in clean energy tech has started to lag considerably:

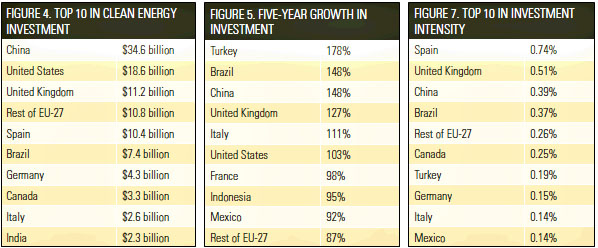

For the first time, China led the United States and other G-20 members in 2009 clean energy investments and finance, according to data released today by The Pew Charitable Trusts. Last year, China invested $34.6 billion in the clean energy economy — nearly double the United States’ total of $18.6 billion. Over the last five years, the United States also trailed five G-20 members (Turkey, Brazil, China, the United Kingdom, and Italy) in the rate of clean energy investment growth.

“The facts speak for themselves,” said Bloomberg New Energy Finance Chief Executive Michael Liebreich. “2009 clean energy investment in China totaled $34.6 billion, while in the United States it totaled $18.6 billion. China is now clearly the world leader in attracting new capital and making new investments in this area.”

….The United States’ clean energy finance and investments lagged behind 10 G-20 members in percentage of gross domestic product. For instance, in relative terms, Spain invested five times more than the United States last year, and China and the United Kingdom three times more.

The raw numbers are below. The full report is here (PDF). The table on the right shows clean energy investment as a percent of GDP, and the United States clocks in at 0.13%, just below Italy and Mexico. That’s pretty grim. You can argue — unpersuasively, I think, but you can argue — that the U.S. is always going to be behind countries like China and Mexico in any industry that’s manufacturing-intensive, but that hardly explains why we’re also considerably behind Europe, Britain, and Canada. It’s why we need a climate bill regardless of whether you take climate change seriously. Everyone else does, and we ought to be competing for our share of the pie.