Yesterday Sen. Ted Cruz introduced his tax plan. Let’s let the Tax Foundation describe it:

This plan would institute a flat 10 percent tax rate on all varieties of individual income, with a large standard deduction and personal exemption….The plan would replace the corporate income tax and all payroll taxes with a broad-based “Business Transfer Tax,” or value-added tax (VAT), with few exemptions.

I just want to make a quick point about this: if it ever became a serious proposal, AARP would go ballistic. Wonks might support a switch from an income tax to a VAT, but old people decidedly don’t. Here’s why.

Businesses would pay Cruz’s VAT and then pass along the cost to consumers. In practice, you can think of it like a sales tax. If it’s been around forever, everything is fine. But if you replace existing income and payroll  taxes with a VAT, the elderly get screwed.

taxes with a VAT, the elderly get screwed.

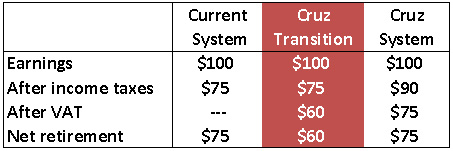

Take a look at the table on the right. To make the arithmetic easy, my example assumes:

- $100 in income.

- A current combined federal income/payroll tax rate of 25 percent.

- A Cruz income tax of 10 percent and a Cruz VAT of 15 percent.

In our current system, you pay 25 percent in federal taxes when you earn your money and sock away the rest in savings. When you retire you can withdraw the original sum without paying further taxes. Of your $100 in original earnings, you have $75 to spend.1

Now look at the last column. This is Cruz’s system once it’s fully established. You pay 10 percent in federal taxes when you earn your money, and when you retire you pay an extra 15 percent federal sales tax on everything you buy with your savings. The net result is the same: you effectively have $75 to spend.

But now take a look at the middle column. Suppose you’re 65. You already paid 25 percent when you earned your money. You have only $75 to withdraw. But you also pay an extra 15 percent on everything you buy. You effectively have only $60 to spend.

This transition problem is well known. It seems a bit arcane, but believe me, AARP knows all about it—and there’s no simple solution. If you transition a VAT slowly, it doesn’t hurt too much. But Cruz doesn’t say anything about that. He just wants to flip a switch. If he ever starts looking like a serious candidate, he’s going to have some serious explaining to do to America’s elderly.

1Don’t worry about interest and inflation. They don’t change the basic picture.