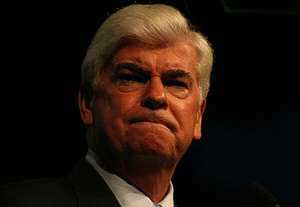

Is Rep. Darrell Issa (R-Calif.) out of line? Senators Chris Dodd (D-Conn.) and Kent Conrad (D-N.D.) are questioning the California Republican’s motivations for investigating Countrywide Financial’s VIP loan program, through which both of the Democrats received financing. “I find it very odd to be investigated and never given a chance to give my side of the story,” Conrad tells Politico. “I think that’s unusual.” Says Dodd, who’s hanging on for dear life to his Senate seat: “This is just too coincidental.”

Issa’s a pretty committed ideologue, so trying to stir up trouble for his Democratic rivals certainly wouldn’t be out of character. But even if his motivations are political, that doesn’t mean Countrywide’s lending practices and influence-peddling loan program shouldn’t be thoroughly investigated. A different question is whether it’s appropriate for Issa to be investigating fellow lawmakers in the first place. Former House general counsel Stanley Brand says Issa has stepped “way, way out of bounds” and that the House oversight committee in general lacks the authority to investigate the ethics of a Senator. That job belongs to the Senate ethics committee, a body not known for its hard-nosed investigative prowess but which is nevertheless moving forward with an inquiry into the Countrywide loans handed out to Dodd and Conrad.

As I noted yesterday, Issa has been leaning on oversight chairman Edolphus Towns to sign on to his Countrywide investigation in a bid to get the blessing of the full committee to subpoena records from Bank of America, which took over the collapsed mortgage lender in 2008. Towns has appeared reluctant to do so—and given the way Dodd and Conrad are reacting, it’s not difficult to see why. He said yesterday that he’ll decide by the end of the week whether he’ll wade into the Countrywide matter. If Issa has indeed crossed a line, as Brand contends, it may not be a bad move for Towns to do so if only to gain greater control over the direction of the investigation.

Meanwhile, elsewhere in Congress, the mortgage market implosion is very much under scrutiny. The Wall Street Journal reported [sub req’d] today that the Senate’s Permanent Select Subcommittee on Investigations has subpoenaed finance firms including Goldman Sachs and Duetsche Bank “seeking evidence of fraud.” The Journal explains:

The congressional investigation appears to focus on whether internal communications, such as email, show bankers had private doubts about whether mortgage-related securities they were putting together were as financially sound as their public pronouncements suggested.

Follow Daniel Schulman on Twitter.