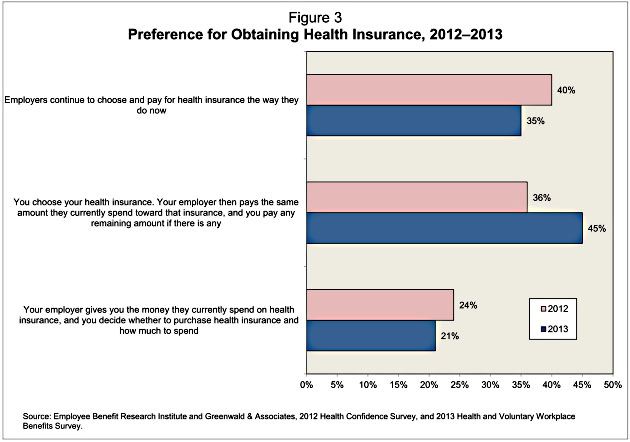

EBRI has released its annual workplace benefits survey, and for the most part it’s a triumph of status quo bias. Most people are fairly satisfied with their benefits and not especially eager for change. But there’s one particular question that produced a different response. Here it is:

I’m scratching my head a bit over this. The thing is, employer health insurance is the gold standard of American health insurance. Sure, every year employee cost sharing rises and copays go up, but it’s still great compared to nearly all individual plans. Deductibles are small and out-of-pocket maxes are low. Plus it’s nontaxable. If you have a choice between employer insurance and individual health insurance, about 99 percent of the time you’d be crazy not to take the employer plan.

And yet, 66 percent (!) of respondents wanted to go out and choose a plan on the open market and then get reimbursed in one way or another. The only thing I can figure is that this demonstrates just how little most people know about health insurance. They have no idea that the full value of employer health insurance is free of income tax, which makes it a great deal compared to spending your own money. Nor, as so many people are suddenly discovering about Obamacare, do they realize that individual plans usually have large deductibles and stratospheric out-of-pocket maxes. For those reasons, buying an individual plan on the open market and then getting reimbursed for it is almost certainly a losing proposition.

Maybe I’m missing something here, and people understood the question differently than me. But on the surface, this sure seems to indicate that most Americans simply have no clue about how health insurance works in this country.